The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

ANDREW M. CUOMO

Governor

LOLA W. BRABHAM

Acting Commissioner

NY19-13

TO: New York State Agency Health Benefit Administrators

FROM: Employee Benefits Division

SUBJECT: Rehired Retirees

DATE: April 16, 2019

This memo is written to inform Health Benefits Administrators (HBAs) of the actions required when an enrollee in the New York State Health Insurance Program (NYSHIP) with New York State retiree benefits returns to employment with New York State.

As a first step, you must determine if the rehired retiree is being employed in a NYSHIP benefits-eligible position. These requirements are listed in the Employee Eligibility section of the current HBA Manual, which may be found online at https://www.cs.ny.gov/employee-benefits/hba/manual/content/.

Rehired Retiree entering a Non-Benefits Eligible Position

Retirees hired in a non-benefits eligible position will maintain coverage as a retiree. If the enrollee or a covered dependent has Medicare, it will remain primary to NYSHIP coverage and the enrollee will continue to be reimbursed for Medicare Part B premiums.

Rehired Retiree entering a Benefits-Eligible Position

If the enrollee returns to a benefits-eligible position, the enrollee can choose to retain retiree coverage or enroll in coverage as an active employee. The HBA should provide the enrollee with the Back to Work flyer to assist the enrollee in making the decision to either maintain Retiree coverage or elect Active coverage.

NYBEAS Job Panel

After you determine the enrollee’s benefits status, it is important to make applicable changes in NYBEAS so that the enrollee’s benefits are processed correctly.

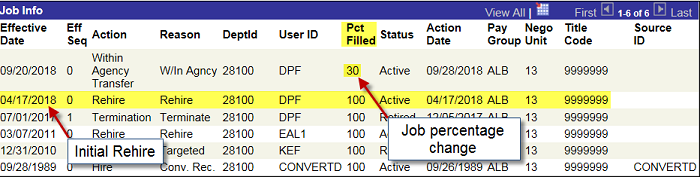

First, the job information should be reflected in NYBEAS with the appropriate working percentage.

Agencies that use NYSTEP: rehire transactions should automatically be brought over to the NYBEAS Job Panel. If the NYBEAS Job Panel does not reflect the correct percentage filled, the HBA should enter a Correction Request.

Agencies that do not use NYSTEP: HBAs entering Job transactions for non-NYSTEP employees must enter the percentage worked in the Rehire transaction.

- An employee in a non-benefits eligible position, should reflect a percentage work of 49% or less.

- An employee in a benefits eligible position, should reflect a percentage work of 50% or more.

Below is an example of a NYBEAS Job Panel that reflects a Rehire and a change in the percentage worked:

NYBEAS Comments

All retirees returning to work must have comments in NYBEAS.

Example of Non-Benefits Eligible Comment: “Employee is a rehired retiree in a non-benefits eligible position effective date (use the date of the rehire or the percentage change to 49% or less).”

Example of Benefits-Eligible Comment: “Employee rehired into a benefits-eligible position effective date (use the date of the rehire or the percentage change to 50% or more).”

NYBEAS Transactions

Employees Choosing to Maintain Retiree Health Insurance Coverage

- NYSTEP (or HBA) processes Rehire on Job Panel in NYBEAS (see “NYBEAS Job Panel” above)

- HBA places comment in NYBEAS stating “Employee rehired into a benefits-eligible position effective date (use the date of the rehire or the percentage change to 50% or more). Employee is maintaining Retiree coverage.”

- HBA sends letter (sample letter template attached) to EBD indicating the following:

- Date rehired

- Benefits-eligible

- Enrollee is maintaining Retiree coverage

- EBD updates Benefit Program to indicate Rehired into a benefits-eligible position

- If applicable, EBD updates Medicare for enrollee and/or dependent to indicate NYSHIP as primary and cease Medicare reimbursement

- If applicable, HBA ensures enrollee is enrolled in NYSHIP Dental/Vision coverage (this may need corrections to the enrollee’s file if enrollee was formerly enrolled in COBRA) and can only be processed after EBD updates the Benefit Program

- HBA must notify enrollee that if pension checks stop, EBD must be notified to update to direct billing

Employees Choosing Active Coverage

- NYSTEP (or HBA) processes Rehire on Job Panel in NYBEAS (see “NYBEAS Job Panel” above)

- HBA places comment in NYBEAS stating “Employee rehired into a benefits-eligible position effective date (use the date of the rehire or the percentage change to 50% or more). Employee is electing Active coverage.”

- HBA writes letter (sample letter template attached) to EBD indicating following:

- Date rehired

- Benefits-eligible

- Enrollee elects Active coverage (attach enrollee letter or PS-404)

- Enrollee has been made aware that they are unable to use sick leave credit in Active coverage status

- EBD updates Benefit Program and enrolls as an Active employee (initial 42/56 day waiting periods apply)

- If applicable, EBD updates Medicare for enrollee and/or dependent to indicate NYSHIP as primary and cease Medicare reimbursement

- If applicable, HBA ensures enrollee is enrolled in NYSHIP Dental/Vision coverage (this may need corrections to the enrollee’s file if the enrollee was formerly enrolled in COBRA) and can only be processed after EBD updates the Benefit Program

- HBA must notify enrollee when deductions from paychecks will begin and indicate any retroactivity

Employee’s Job Percentage Changes

- HBA submits a Correction Request to change job percentage (see “NYBEAS Job Panel” above)

- HBA places comment in NYBEAS stating “Employee’s job percentage changed to ____ percentage (use the new job percentage amount) effective date (use the date of the percentage change). Employee is now benefits-eligible or is no longer benefits-eligible (choose what is applicable to the situation).”

- HBA sends letter (sample letter template attached) to EBD indicating the following:

- Date job percentage changed

- Benefits-eligible or not benefits-eligible

- If employee is now benefits-eligible, please refer to procedures under “Employees Choosing to Maintain Retiree Health Insurance Coverage” or “Employees Electing Active Coverage”

- If employee is now non-benefits eligible, please refer to procedures under “Employee Terminates (Re-retires)”

Employee Terminates (Re-retires)

- NYSTEP (or HBA) processes Termination on Job Panel in NYBEAS

- HBA places comment in NYBEAS stating “Employee has left State service effective date (use the date of the job termination).”

- HBA sends letter (sample letter template attached) to EBD indicating the following:

- Date terminated

- EBD updates Benefit Program to indicate Retired

- If applicable, EBD updates Medicare for enrollee and/or dependent to indicate Medicare as primary and begin Medicare reimbursement

- If applicable, HBA must notify enrollee that their NYSHIP Dental/Vision coverage will terminate and EBD will send them a COBRA application

- HBA must notify enrollee that if pension had stopped and is beginning again, EBD must be notified to update to pension deduction

- If applicable, get proof from the enrollee that they suspended or never collected a State pension or if they did not begin withdrawing funds under the SUNY ORP. Then, send to EBD along with the new sick leave accruals and salary information (see “Re-calculation of Sick Leave Credit” below).

Re-calculation of Sick Leave Credit

When a New York State retired enrollee is rehired, regardless if they elect to maintain Retiree coverage or enroll in Active coverage, their sick leave credit may be re-calculated when they retire again. However, sick leave is only re-calculated for enrollees who have suspended their State pension or never begun collecting, or if they did not begin withdrawing funds under the SUNY Optional Retirement Program (ORP).

Rehired retirees who continue to collect their State pensions or who have begun to withdraw funds under a SUNY ORP, such as TIAA, do not have their lifetime monthly credit for sick leave recalculated when they retire again.

For Rehired Retirees who suspend State pension or have not been collecting a State pension or have not begun withdrawing funds under the SUNY Optional Retirement Program:

Returning Within One Year of Retirement

At the time of the subsequent retirement:

- Sick leave credit is calculated based on the new accruals and salary (the credit could be higher or lower than what was previously reported)

- There may be a change in the contribution rate (the contribution rate will be the rate in place at the time of the most recent retirement)

Note: Under both the Attendance Rules for the Classified Service and the SUNY rules for SUNY Unclassified Service, the sick leave accruals at the time of retirement are restored in full for former employees who return to State service within one year of separation.

Returning After One Year of Retirement

At the time of the subsequent retirement:

- Sick leave credit is calculated based on the new accruals and salary. However, since previous accruals have not been restored, the new credit will be added to the previously calculated sick leave credit, not to exceed the maximum number of days

- There may be a change in the contribution rate (the contribution rate will be the rate in place at the time of the most recent retirement)

For more information on sick leave credit for rehired retirees, please refer to the Rehired Retiree – Sick Leave Credit section of the HBA Manual.