Search the

Attendance & Leave

Manual

- 21.1 Sundays & Holidays

- 21.2 Vacation

- 21.3 Sick Leave

- 21.4 Extended Sick Leave

- 21.5 Sick Leave at Half-Pay

- 21.6 Personal Leave

- 21.7 Leave for Extraordinary Weather Conditions

- 21.8 Workers' Compensation Leave

- 21.9 Leave for Subpoenaed Appearance and Jury Attendance

- 21.10 Leave for Civil Service Examinations

- 21.11 Leave for Quarantine

- 21.12 Leaves Required by Law or Negotiated Agreement

- 21.13 Leave for Civil Defense Duties

Drawing of Earned Credits Upon Separation

(Part 23)

- 23.1 Payment for Accruals Upon Separation

- 23.2 Payment for Accruals Upon Entry into Armed Forces

- 23.3 Payment for Overtime Accruals Upon Appointment, Promotion or Transfer

Crediting Other Public Service Employment as State Service (Part 24)

A. Civil Service Attendance Rules

B. Calendar of Legal Holidays Religious Holy Days

Absence With Pay (Part 21)

Section 21.8 - Workers' Compensation Program - (Part 3 of 3, C-2 through C-33)

[Go to Part 1; C-1 through C-9]

[Go to Part 2; C-10 through C-19]

C-20 Supplemental Pay Program

Introduction

The discussion on pp. C-20 through C-33 of this Section [that follows] is a description of the workers' compensation benefit that applies to the following employees:

Employees in ASU, ISU, OSU, PS&T and RRSU who have Attendance Rules coverage and whose absence is caused by a workers' compensation injury or disease resulting from an accident or incident that occurred on or after April 1, 1986.

Eligibility

To be eligible to receive benefits, an employee must have attendance rules coverage and must be disabled because of an occupational injury or disease as defined in the Workers' Compensation Law. In addition to bargaining unit employees who are subject to the Attendance Rules of the Civil Service Commission, employees subject to the following Attendance Rules are eligible: Attendance Rules for Institution Teachers of the Department of Correctional Services, Attendance Rules for Institution Teachers of the Office of Mental Health, Attendance Rules for Institution Teachers of the Office of Mental Retardation and Developmental Disabilities, Attendance Rules for Institution Teachers of the Division for Youth; civilian personnel subject to the Attendance Rules of the Division of State Police; and employees of Rome School for the Deaf and Batavia School for the Blind who are subject to the Regulations of the Commissioner of Education.

Annual salaried full-time and part-time employees (including those employed on a seasonal basis) have attendance rules coverage and are eligible for this benefit. Full-time and part-time employees (including those employed on a seasonal basis) who are paid on an hourly or per diem basis must have gained Attendance Rules coverage, by having completed the required 19 qualifying biweekly pay periods, prior to becoming eligible for this benefit. However, once rule coverage is attained, these employees' benefits are identical to those available to annual salaried employees.

For the purpose of entitlement to any employer-provided workers' compensation benefits, the State of New York is considered to be one employer. Therefore, if an employee has a work-related injury or disease from employment with agency A, moves to agency B and is again absent for the same condition, agency B must provide such employee with any benefit not already used at agency A and, therefore, still available for this injury or disease. Likewise, if a person works for two state agencies and incurs an occupational injury at one of them, the employee must be given leave benefits by both employers, to the extent he/she is eligible, and the benefits provided by each employer must be added together to determine the total benefit used by the employee.

TM-6 - No Substantive Changes - January 1991

An employee who has a full-time annual salaried position in one agency and an extra-service position in another agency, who incurs an occupational injury with either employer, is entitled to leave from the annual salaried position (Attendance Rules coverage) and no leave from the extra-service position (no Attendance Rules coverage).

The eligible employee's entitlement to either the workers' compensation leave program or supplemental pay program is determined by the bargaining unit to which the employee belonged at the time of the accident or injury. For example, an eligible employee is injured on October 1, 1988 while in the Security Services Unit. He changes jobs on October 15, 1988 and is in an Institutional Services Unit position. On November 3, 1988 he begins losing time from work due to his October 1, 1988 accident. This employee is eligible for the workers' compensation leave benefit for any disability related to the October 1, 1988 accident because his absence is due to an incident that occurred while he was subject to the provisions of the Security Services Unit agreement. Any new incidents which occur while he is an Institutional Services Unit employee will be subject to the provisions of the supplemental pay program.

Waiting Period

- No wage replacement benefit is payable if the absence due to a workers' compensation injury or disease does not exceed seven calendar days.

- If absence is for at least eight calendar days, but does not exceed 14 calendar days, wage replacement benefits are payable beginning with the eighth day of absence.

- Once absence due to a single injury or disease is for 15 calendar days or more, wage replacement benefits are payable retroactively to the first day of absence.

These waiting period provisions contained in the Workers' Compensation Law have been incorporated into the workers' compensation benefit provided in the subject negotiated agreements. During the waiting period, employees must be allowed to charge absences to leave credits. If the absence due to an injury or disease never exceeds 14 calendar days, credits charged during the first seven calendar days are not returned because there is no wage replacement benefit payable.

There is, however, one exception to the statutory waiting period. An employee whose injury involves limbs or facial disfigurement may be entitled, under the Workers' Compensation Law, to a wage award based on a "schedule loss." That is, the employee is eligible for a minimum number of weeks of wage replacement, as identified on a schedule in the Law, regardless of the actual amount of lost time. An employee who receives a schedule loss and whose absence is less than eight calendar days, is entitled to have leave accruals that were charged as a result of the occupational disability recredited. State Insurance Fund Form C-8 indicates the time period covered by the schedule loss award. Only accruals that were actually charged should be recredited.

TM-6 - New or Revised Material - January 1991

The first day of compensable lost time for the purpose of calculating the waiting period and eligibility for benefits is determined by the State Insurance Fund (SIF). The appointing authority, when reporting an accident or incident to SIF, must include the time and date of the accident/incident. When SIF notifies the agency that it is ready to begin making payments, it will specify the dates covered. From that, the agency will know which day is considered to be the first day of compensable lost time for the purpose of calculating both the nine-month supplemental benefit and the total absence.

The Workers' Compensation Law statutory waiting period is applied only once per injury or disease and is met by cumulating the employee's absences in days.

Advanced Leave

This workers' compensation benefit contains a provision for keeping an employee eligible for benefits in full-pay status during the time between exhaustion of all available leave credits and receipt of the award and supplement. This is called "advanced leave." (Please note that this is not Extended Sick Leave under Section 21.4 of the Rules which has a five-day maximum.) Once an employee has been absent for at least eight calendar days and the appointing authority is satisfied that such employee will be eligible for the supplemental pay benefit, the employee must be placed on "advanced leave," upon exhaustion of all other leave credits, unless the employee requests otherwise in writing. An employee absent for 15 calendar days or more is eligible for advanced leave beginning with the first day of lost time. This advanced leave is "repaid" by the employee because the employee remains on the supplemental payment system upon return to work for the number of work days equal to the number of days he or she received "advanced leave" at the beginning of his/her absence. The only difference between charging leave credits and being on "advanced leave" during the period prior to receipt of the supplemental pay benefit is that, when the employee is recredited with leave used during that period, there is nothing to be recredited for a period of "advanced leave."

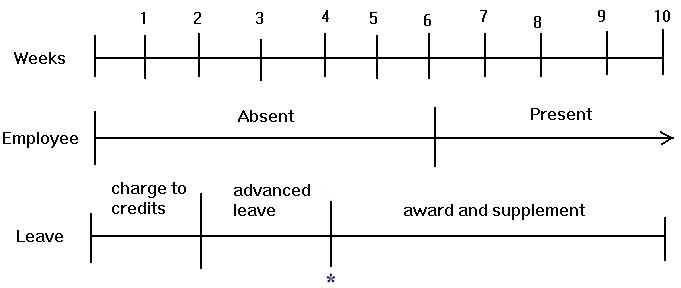

An employee who is continuously absent for six weeks, for example, is eligible for the pay benefit beginning with the first day of compensable lost time. Assume that this employee charges two weeks (weeks 1 and 2) to leave credits and then runs out of credits and is placed on advanced leave for two weeks (weeks 3 and 4) before the supplemental pay begins (weeks 5 and 6). When the supplemental pay begins, the employee is eligible to have the two weeks of leave credits (weeks 1 and 2) recredited. This employee remains on the supplemental payment system for the remaining two weeks of absence (weeks 5 and 6) and continues on the supplemental payment system for the next four weeks (weeks 7-10) that he or she is back at work (the two weeks of charging leave credits [weeks 1 and 2] and the two weeks of advanced leave [weeks 3 and 4]).

TM-6 - New or Revised Material - January 1991

The time line below graphically illustrates this example.

* Recredit two weeks of accruals.

An employee absent on advanced leave accrues biweekly credits and is eligible to be granted vacation bonus days, additional vacation days and personal leave but is not entitled to have his/her status changed to use those credits.

If it is subsequently determined that an employee was not eligible for advanced leave, for example, because he/she was not absent due to a work-related injury/illness, the employee must repay all advanced leave in a manner prescribed by the State Comptroller.

An employee who is receiving advanced leave, prior to being placed on the supplemental payment system, is considered to be in full-pay status for the purpose of Civil Service Rules and Regulations.

Compensation Benefit

This workers' compensation benefit is payable for nine cumulative months (39 weeks) of absence for each occupational injury or disease as determined by the Workers' Compensation Board. The wage benefit is payable from two sources. The employee will receive direct payments from the State Insurance Fund of the wage replacement benefits due under the Workers' Compensation Law. The employee will also receive from the Office of the State Comptroller a supplemental paycheck which will be calculated to provide the employee with his/her current net salary.

Net salary is defined as an employee's normal gross salary minus all taxes and FICA. The Office of the State Comptroller will calculate an employee's net salary and will recalculate the supplemental paycheck each time the State Insurance Fund payments change to ensure that the employee receives full "net" salary for all eligible absences in the combined income from the two checks. The payroll requirements are detailed in Office of State Comptroller Payroll Bulletin No. P-665, dated September 4, 1990.

TM-6 - New or Revised Material - January 1991

Following exhaustion of this nine-month compensation benefit, an employee is eligible to charge leave credits and must be granted any sick leave at half-pay for which he/she is eligible and leave without pay until the absence totals one cumulative year for any single injury or disease. (Further leave is at the discretion of the appointing authority.)

Regardless of the employee's eligibility for workers' compensation benefits from his/her employer under either the Leave Program or the Supplemental Pay Program, both medical expenses and wage replacement benefits provided by the Workers' Compensation Law continue while the employee is disabled. To insure the employee receives the correct benefit pursuant to the Workers' Compensation Law and negotiated agreements, it is critical that the agency keep the State Insurance Fund informed of the employee's status throughout the period of disability.

Status

While an employee is absent and receiving pay from the supplemental payment system he/she is considered to be on a full paid leave for the purpose of Civil Service Rules and Regulations. An employee who has returned to work, although still being paid from the supplemental payment system, is treated in the same manner as any other employee who is physically present at work. That is, an employee present at work but on the supplemental payment system earns overtime compensatory time and must be paid overtime (based on normal gross salary) if he/she works beyond 40 hours. Also, the employee is eligible for holiday pay and all other additional salary factors available to employees who are at work.

Section 71 Civil Service Law

The supplemental payment system in no way changes the provisions of Civil Service Law. Section 71 provides that an employee who is disabled as the result of an occupational injury or disease is entitled to a leave of absence for a minimum of one cumulative year (365 calendar days) unless found to be permanently disabled.

The cumulative year of mandatory leave includes periods of award and supplement, periods of absence charged to leave credits, periods of advanced leave, sick leave at half-pay and periods of leave without pay. For calculation of the "cumulative year" see page 3 [R-3] of this Section.

Employees absent for one cumulative year because of an occupational injury or disease may be continued in employment at the discretion of the appointing authority but are not entitled to be so continued.

TM-6 - New or Revised Material - January 1991

Procedural guidelines for the implementation of Rule 5.9 of the Rules for the Classified Service which details the notification and appeal provisions required by Section 71 are contained in the State Personnel Management Policy Bulletin #90-02 dated July 5, 1990. [Since replaced by Policy Bulletin #93-02 in 2200 Separations and Leaves]

Earning Leave Credits

While absent and charging leave credits or receiving advanced leave because of an occupational injury or disease, an employee earns normal biweekly leave credits. This employee is also granted vacation bonus days or additional vacation credits and personal leave, if the anniversary dates fall during this period. An employee absent and on the supplemental payment system is considered to be in full-pay status for the purpose of crediting leave and, therefore, earns and is granted leave credits in the same manner as the employee in full-pay status. Once an employee returns to work, eligibility to earn and be granted leave credits is determined by his/her actual attendance during each pay period.

Whenever an employee in one of the bargaining units covered by this benefit is absent due to an occupational injury or disease, he/she is considered to have invoked the contract provisions which allow exceeding the 40-day vacation maximum and, therefore, must be allowed to accumulate vacation beyond the maximum until the following March 31. (Employees in the PS&T Unit and RRSU can always exceed 40 days except on April 1 each year. ) Refer to p. C-27 of this Section for the impact of restored credits on vacation maximums.

Agencies should advise employees of their leave balances during a period of absence and alert them to their rights to request use of leave credits prior to issuance of the nine-month supplemental pay benefit to avoid losing these credits. For example, an ISU employee who has a high vacation balance and whose disability may extend through April might request use of vacation to avoid losing credits over 40 days on April 1. An employee may choose to use personal leave prior to placement on the pay benefit to avoid loss of those days if his/her anniversary date is approaching. Of course, this extends entitlement to the supplemental pay benefit for the same number of days in the future as the employee has charged to leave credits.

Credits used in lieu of placement on the supplemental payment system will be restored to the employee pursuant to a Workers' Compensation Board award. They are not recredited credits because the employee chose to use credits rather than start the supplemental pay benefit. These periods are treated in a manner similar to those that occur after exhaustion of the nine-month benefit when the employee is charging credits (which are later restored following an award by the Workers' Compensation Board).

TM-6 - New or Revised Material - January 1991

Use of Leave Credits

Leave credits may be used during the waiting period or an employee may request leave without pay. Leave credits may also be used for all absences prior to the start of the compensation benefits from the State Insurance Fund and State Comptroller. An employee may request to use leave credits prior to receiving the nine-month supplemental pay benefit and the request must be approved. An employee may not interrupt a period of payment on the supplemental payment system to charge leave credits. The option to charge credits rather than begin the supplemental pay benefit can only be exercised prior to placement on the supplemental payment system. Once the nine-month pay benefit is exhausted, an employee is eligible to use leave credits and must be granted the sick leave at half-pay for which he/she is eligible for all additional absences until the cumulative total absence exceeds one year.

Once an employee has returned to work (whether receiving full pay or supplemental pay), use of leave credits is subject to the same procedures applied in any other circumstance. For example, holiday time off and requests for vacation are processed in the same way regardless of payroll status. Leave credits used are charged in accordance with the employee's actual work schedule. An employee who returns to work on a five 8-hour-day schedule who requests and has approved a day of personal leave charges eight hours, the number in the actual schedule. (This use of leave credits while on the supplemental payment process in no way entitles an employee to any additional salary.)

After an employee has returned to work following the initial period of disability, occasional absences related to the workers' compensation case, such as doctor visits, therapy or workers' compensation board hearings may occur. These absences must initially be charged to leave credits as all absences are charged. Until these absences are deemed compensable by the Workers' Compensation Board and a Notice of Decision is issued, the supplemental pay benefit will not be provided and agencies are precluded from recrediting or restoring the time charged.

These Supplemental Pay Program procedures differ from the provisions of the Leave Program which allow for the granting of workers' compensation leave with pay without charge to credits for all absences related to the disability up to the 6-month entitlement.

Recrediting Leave Credits

The employee absent due to a work related disability shall not suffer any loss of wages because of the disability. In order to maintain the employee in pay status while awaiting placement on the supplemental payment system, the agency "borrows" leave credits from the employee. At the point the employee returns to work, begins receiving supplemental payments, terminates service, or the nine-month benefit expires, whichever occurs first, these credits (used for compensable absences) are recredited to the...

TM-6 - New or Revised Material - January 1991

...employee (i.e., given back). The employee will receive the wage replacement (supplemental pay plus award) for periods of compensable absence for which leave credits were charged and recredited.

Leave credits used during the first seven calendar days of absence cannot be recredited unless an employee's absence exceeds 14 calendar days. These leave credits are then recredited to the employee when the employee begins receiving supplemental payments or returns to work, whichever occurs first, because he/she is eligible for wage benefits retroactive to the first day of absence. Leave credits used during the eighth through fourteenth day of absence are recredited to the employee when he/she begins receiving supplemental payments or returns to work, whichever occurs first, because he/she is eligible for wage replacement benefits beginning on the eighth day of absence. Leave credits used to keep an employee who is absent in full-pay status pending receipt of the supplemental pay benefit are also recredited to the employee when he/she begins receiving supplemental payments or returns to work, whichever occurs first. There are no restrictions on the use of the leave so recredited to the employee.

The contract language provides no benefit not already provided under the Attendance Rules for employees who exceed the vacation maximum or pass their personal leave anniversary. Personal leave cannot be recredited beyond the date it expired. When an employee charges personal leave while waiting to receive supplemental payments and the personal leave anniversary date passes prior to recrediting of the used personal leave, the employee is credited with new personal leave days on the anniversary date and is not recredited with previously used personal leave.

Restoring Leave Credits

Credits considered to have been used and restored are those leave credits and sick leave at half-pay entitlement used by an employee after exhaustion of the 9-month benefit (or prior to receipt of the benefit at the employee's request). When the Workers' Compensation Board issues an award in favor of the employee, the wage replacement is credited to the State and all leave credits and sick leave at half-pay charged for the period of time covered by the Board award are restored to the employee. (If an employee's personal leave anniversary date has passed prior to restoral, personal leave credits cannot be restored.) These restored leave credits cannot be used for future absences caused by the same injury or disease. Should the restoration of these leave credits bring an employee's balances over the allowable maximums, the employee will have one year from the date of restoration or return to work, whichever is later, to reduce the balances to the allowable maximums. This provision is considered to supersede Article 10.5 of the ASU agreement, 10.6 of the ISU agreement, 10.5 of the OSU agreement, 12.4(c) of the PS&T agreement and 12.4(a) of the RRSU agreement...

TM-6 - New or Revised Material - January 1991

...on vacation maximums. (These provisions pertain only to restored credits not recredited credits). Credits restored pursuant to these provisions are not lost on March 31. Refer to p. C-25 of this Section for the impact of earning leave credits while absent due to a work-related injury.

Holidays

Employees absent in full-pay status charging leave credits or receiving advanced leave are eligible to observe holidays. If a holiday occurs during this period and coincides with a regular workday, the employee is considered to have observed the holiday; i.e., the employee remains in pay status, no leave credits of any kind are earned or charged for the day and no leave is advanced for the day. However, employees are eligible to earn pass day holidays and floating holidays that occur during these periods.

Employees absent and receiving the supplemental pay benefit do not observe holidays and may not be credited with any holiday leave, except floating holidays. Of course, they do receive the award and supplement continuously whether or not a designated holiday falls during the period of absence.

Upon return to work, employees are eligible for holiday benefits even though they may continue on the supplemental payment system. That is, employees on approved absence on a holiday receive their supplemental pay and are considered to be observing the holiday. Employees who work on a holiday are eligible to receive holiday pay (based on normal gross salary) or holiday leave as appropriate.

Other Leaves

An employee absent due to an occupational injury or disease receives workers' compensation benefits pursuant to the negotiated agreements, as long as such employee remains disabled due to that injury or disease. Days of absence are counted toward the cumulative total of one year regardless of the employee's ability to engage in activities other than his/her regular job duties. Therefore, an employee may be able to perform jury service, take a Civil Service examination or complete some military duty while absent and receiving a workers' compensation benefit. The employee remains on the supplemental payment system while he/she is engaged in these other activities as long as he/she remains disabled from his/her regular job duties.

Once an employee returns to work, eligibility for other leaves is based on applicable rule and contract provisions. The fact that the employee is receiving supplemental payments does not change eligibility for these leave benefits for the employee who is at work.

TM-6 - New or Revised Material - January 1991

Controverted or Contested Claims

Eligibility for the workers' compensation benefit under the contracts is dependent upon the State Insurance Fund/Workers' Compensation Board determination that a disability exists which resulted from an occupational injury or disease. Whenever the SIF controverts a claim (because it is alleged that the injury or disease did not occur on the job or it is alleged that the employee has not suffered any such injury or disease), the employee is not eligible for benefits under these Articles. In the case of nonwork-related illness or injury, the employee continues to be eligible to use his/her leave credits and be granted sick leave at half-pay as is the case for any ordinary disability. If the SIF has denied benefits because they believe there is no illness or injury, an employee is expected to be present at work. An absence may be considered unauthorized, until such time as the controversy is resolved, if the employee does not, in fact, return to work.

If a controverted claim is resolved in favor of an employee by the Workers' Compensation Board, the SIF must begin making payments and the employee becomes eligible for the negotiated benefit, including supplemental payments from Office of the State Comptroller. If an employee was on leave without pay during the period of contested absence, SIF payments and supplemental payments will be made in lump sums directly to the employee. An employee who used leave credits should be recredited with all such credits used, will be placed on the supplemental payment system and will receive the award and supplement for a period of time equivalent to the previous absence for which the Board award was made.

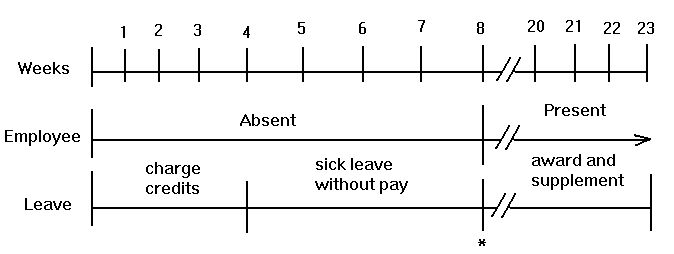

For example, an employee absent for eight weeks due to an alleged compensable injury charges four weeks to leave credits (weeks 1-4) and is placed on sick leave without pay for four weeks (weeks 5-8) because SIF controverts the claim as not being job-related. The Workers' Compensation Board subsequently holds a hearing and finds the employee's claim to be compensable. SIF is obligated to make a lump sum payment for wage replacements due for the four weeks of leave without pay (weeks 5-8). The Office of the State Comptroller will then calculate the supplement due for the same four weeks (weeks 5-8) and issue a lump sum payment. The employee will be placed on the supplemental payment system receiving an award and supplement for four weeks to provide the benefit that should have been received during the four weeks the employee was charging credits (weeks 1-4). At the time the employee is placed on the supplemental payment system the appointing authority will recredit the credits the employee used for the first four weeks (weeks 1-4) and credit the employee with accruals he/she should have earned for the next four weeks (weeks 5-8) but didn't because of the leave without pay.

TM-6 - No Substantive Changes - January 1991

The time line below graphically illustrates this example.

*Four weeks of leave credits recredited. Lump sum payment of both SIF payment and State Comptroller supplement to be made.

Priority Medical Examinations

A priority medical examination's (PME) purpose is to determine as quickly as possible after an incident whether an employee is disabled. The PME determines disability on the day of the exam and is used to grant or deny the employee's claim for workers' compensation benefits.

PMEs are scheduled by the State Insurance Fund to be conducted within 3 days of receiving a request from an agency. A PME will have the greatest impact if it is completed within seven calendar days of the beginning of the employee's absence from work.

An agency should request a priority medical examination when any of the following conditions exist:

- The period of disability is indeterminate.

- The liability is questionable.

- The existence of disability is questionable.

Effective April 1, 1988 the three CSEA unit agreements contain provisions which authorize appointing authorities to place employees who miss priority medical examinations on leave without pay. Specifically, the employee may be placed on leave without pay beginning with the day of the missed exam until the next appointment which the employee attends or the date the employee returns to work, whichever is sooner, but not to exceed two days for each missed priority medical examination. The appointing authority may waive this provision upon receipt of an acceptable explanation from the employee. Prior to placing an employee on leave without pay, the appointing authority must verify with the State Insurance Fund that the Fund can attest to a timely notification to the employee of the scheduled exam.

There is no limit on the number of times an employee may be placed on leave without pay for missing priority medical exams but each leave shall not exceed two days. Appointing authorities should notify employees of their rights and responsibilities under this provision and should include procedures for submitting waiver requests.

TM-6 - New or Revised Material - January 1991

When either the State Insurance Fund or the Workers' Compensation Board determines that a period of leave without pay under this provision is a compensable absence, and the employee has met the waiting period, the employee will receive award and supplement for those days in the same manner as he/she would for any absences on leave without pay that were subsequently found to be compensable. If, however, the absence occurred during a waiting period that will not be covered by award and supplement, the appointing authority may either let the leave without pay stand or allow the employee to charge credits upon receipt of a satisfactory explanation for missing the exam in accordance with the provisions of the agreement.

Consultant Medical Examinations Through SIF

In addition to the priority medical examination program, the State Insurance Fund utilizes consultant physicians with expertise in various medical specialties who can conduct examinations to verify continuing disability and causal relationship. The SIF may schedule consultant examinations based on their review of the case. The agency can also request an examination when, for example, the information provided by the employee's personal physician is insufficient or there is a question of continuing disability. Agency personnel should discuss their concerns with the SIF representative to determine at what point a consulting physician examination is warranted.

Return-to-Work Examinations

At the time an employee wishes to return to work, if an agency is in doubt as to the employee's fitness, the agency may request the Employee Health Services (EHS) to examine the employee prior to allowing the individual to return to work. These examinations should not be routinely scheduled. Where there is medical documentation from the employee's physician or an SIF physician that the employee is fit to return, the agency should, in the majority of cases, accept this documentation. If, however, the agency has good and sufficient reason to doubt the employee is capable of performing the job duties of the position, the agency can request the employee be examined by EHS. This request should include all pertinent identifying information on the employee, a complete duties description and copies of all medical documentation pertaining to the injury/illness.

Medical Documentation

In addition to documentation provided by the SIF physicians, EHS physicians and, in some cases, agency physicians, appointing authorities should continue to request and expect to receive medical documentation from the employee's personal physician substantiating the employee's need to be absent due to the workers' compensation disability. Except for a priority medical by SIF immediately following an incident, the initial source of...

TM-6 - New or Revised Material - January 1991

...medical documentation usually will be the employee's personal physician. (An employee who refuses a reasonable request to provide medical documentation to substantiate an absence, pursuant to rule or contract, can be placed on unauthorized absence pending receipt of acceptable documentation or notification by the SIF that such documentation exists and the absence is considered compensable).

Appointing authorities are expected to share all pertinent medical documentation with appropriate SIF officials. The SIF staff will be sharing medical documentation they obtain with their agency contacts.

Return to Duty on a Reduced Schedule or to a Limited Duty Assignment

An employee who is not able to return to duty and work his/her full normal work schedule may, at the discretion of the appointing authority, be allowed to return to modified duty. The employee might work a reduced schedule or limited duty for a brief or extended period of time pending full recovery. The employee, however, is not entitled to return to duty until he/she is able to perform the normal and regular duties of his/her position working a normal work schedule. If the employee is allowed to return on modified duty, such employee may be granted the supplemental leave benefit (subject to the 39-week limitation) to cover the difference between the hours worked and the number of hours in the normal workday or workweek. Arrangements must be made with the State Insurance Fund to process these payments.

In the case where an employee is allowed to return to work on a reduced schedule or to a limited duty assignment, the appointing authority should specify in writing the duration of the arrangement. If the employee is not able to return to full duty status at the end of this period, the appointing authority must decide whether to continue the arrangement for an additional period or to return the employee to full-time supplemental leave.

Record Keeping

An employee's time record needs to reflect all transactions concerning the employee's absence due to each individual occupational injury or disease. It is recommended that agencies use the SIF case file number or date of accident on time records so that each absence is associated with the appropriate case. This is important not only for payment purposes, but also to calculate the one calendar year minimum entitlement available for a single injury or disease and to be able to recredit or restore leave credits accurately.

TM-6 - New or Revised Material - January 1991

Once an employee has been absent for more than 14 calendar days, the time records should be corrected to reflect workers' compensation benefit eligibility beginning with the first day of compensable lost time. It will be some time from the first day of compensable lost time to the first day of supplemental payment and the employee will be charging leave credits or be receiving "advanced leave" during this period. Careful notations need to be made on the time records so that when an employee begins the supplemental payment system, credits charged can be recredited appropriately and total absence properly documented. While each time record should not be changed physically, there should be an official memorandum to the file and a notation on the time record to reflect the recrediting of used leave at the time the employee begins award and supplement. The record of actual absences on full-pay shown on the time records, prior to beginning award and supplement, is documentation that substantiates the amount of time it is necessary for the employee to remain on the supplemental payment system either following return to work or while charging leave credits following exhaustion of the nine-month benefit.

Time records must be maintained throughout an employee's absence since leave is credited to the employee as if he/she were in full-pay status and the absences need to be documented. Once an employee returns to work, he/she earns the usual leave credits consistent with his/her actual attendance without regard to the fact that salary payments are being received from the supplemental payment system. In other words, time records reflect real time and not delayed time (unlike the award and supplemental payments).

Additional information that needs to be kept with an employee's time records includes the dates when leave credits are restored if the restoration brings the employee over the allowable maximum. Employees have one year from return to work or restoration of leave credits, whichever occurs later, to reduce leave credits below the maximum, and employees continue to earn leave credits throughout this period. Also, the amount of restored leave credits needs to be recorded because such restored credits are not available for reuse for an absence related to the same injury or disease. Restored leave credits should be charged for unrelated absences until these restored credits are used up. (In contrast, recredited leave credits are available for use in connection with the same accident or injury.)

The Workers' Compensation Board and State Insurance Fund do not maintain records of benefit enhancements provided to State employees. It is advisable to retain records on each workers' compensation case for six years after an employee retires or, if an employee transfers to another agency, to make them available to that agency. The agency needs the information in these records to ensure that an employee receives only the benefits to which he/she is entitled if the case is reopened.

TM-6 - New or Revised Material - January 1991

|

|

|

| C-1, 3, 4, 6-8, 10, 15-20, 29 | No Substantive Changes |

| C-2, 5, 9, 11-14, 21-28, 30-33 | New or Revised Material |