Search the

Attendance & Leave

Manual

- 21.1 Sundays & Holidays

- 21.2 Vacation

- 21.3 Sick Leave

- 21.4 Extended Sick Leave

- 21.5 Sick Leave at Half-Pay

- 21.6 Personal Leave

- 21.7 Leave for Extraordinary Weather Conditions

- 21.8 Workers' Compensation Leave

- 21.9 Leave for Subpoenaed Appearance and Jury Attendance

- 21.10 Leave for Civil Service Examinations

- 21.11 Leave for Quarantine

- 21.12 Leaves Required by Law or Negotiated Agreement

- 21.13 Leave for Civil Defense Duties

Drawing of Earned Credits Upon Separation

(Part 23)

- 23.1 Payment for Accruals Upon Separation

- 23.2 Payment for Accruals Upon Entry into Armed Forces

- 23.3 Payment for Overtime Accruals Upon Appointment, Promotion or Transfer

Crediting Other Public Service Employment as State Service (Part 24)

A. Civil Service Attendance Rules

B. Calendar of Legal Holidays Religious Holy Days

Policy Bulletin No. 1993-04

(Part 2 pp. 13 - 26)

Section 21.8 Workers' Compensation Leave - June 23, 1993

[For faster downloading, this bulletin is broken down here into three parts.]

- Part 1 pp. 1 - 12

- Part 2 pp. 13 - 26

- Part 3 pp. 27 - 37]

TABLE OF CONTENTS (Part 2)

- Sick Leave at Half-Pay

- Restoring Leave Accruals

- Eligibility for Overtime

- Controverted or Contested Claims

- Section 71 Civil Service Law and Rule 5.9

- CLAIMS PROCESSING

Sick Leave at Half-Pay

Time spent on workers' compensation disability leave with percentage supplement counts as time worked for purposes of calculating an employee's maximum available sick leave at half-pay entitlement. For example, an otherwise eligible employee on workers' compensation disability leave with percentage supplement for six months earns an additional payroll period of sick leave at half-pay eligibility.

Employees absent under this Medical Evaluation Program are not permitted to use sick leave at half-pay except when they would be permitted to charge leave accruals, if available, for full day absences (see Charging Leave Accruals).

Restoring Leave Accruals

Under this Program, leave accruals charged and sick leave at half-pay eligibility used are restored to the employee on a prorated basis only following a Notice of Decision by the Workers' Compensation Board (WCB) crediting New York State for wages paid. There is no recrediting of leave accruals under this Program.

The restoration of leave credits is proportional, based on the credit New York State receives from the State Insurance Fund and the supplement for which the employee may be eligible. The information needed to determine the proportion of credits to be restored is obtained from the C-8 EMP form issued by the State Insurance Fund following a Workers' Compensation Board hearing and the payroll register. If you have a question, please contact your agency's regular claims examiner at the State Insurance Fund upon receipt of the C-8 EMP to verify the number of days for which New York State received credit and the total net dollar amount credited to NYS (the total net credit is the total dollar credit to NYS minus any deductions authorized by the WCB). Using these figures, the supplement amount, if any, and the employee's normal biweekly gross salary at the time of the accident, a percentage of proration of credits to be restored is calculated.

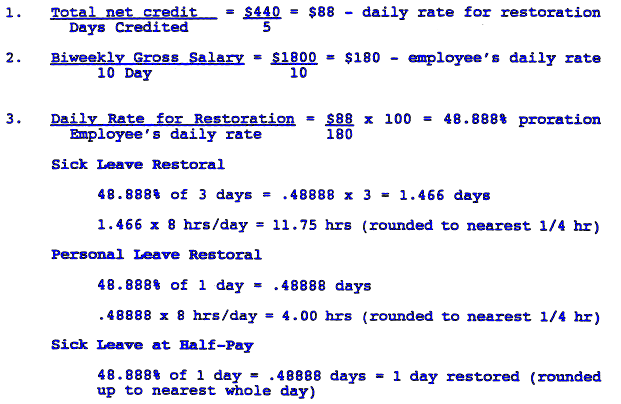

The following procedure explains this process:

- Divide the total net credit from SIF plus the gross supplement paid on the State payroll by the number of days credited to obtain the daily rate for restoration;

- Divide the employee's normal biweekly gross salary at the time of the accident by 10 to obtain the employee's daily rate (for purposes of proration we are using this simplified version of the daily rate);

- Divide the daily rate for restoration by the employee's daily rate and multiply by 100 to obtain the proration percentage;

- This proration percentage is then applied separately to each category of leave credits charged by the employee to determine the number of days of leave in each category to be restored. (NOTE - the amount of restored credits cannot exceed the actual number of credits charged;)

- Convert the number of days to be restored to hours by multiplying the number of days by either 7.5 or 8 as applicable;

- Round the number of hours up to the nearest quarter hour;

- Sick leave at half-pay eligibility is restored in the same manner. However, there is no conversion to hours, the days restored are rounded up to the nearest whole day.

In each case, the employee will be restored a percentage of the number of days charged and/or sick leave at half-pay granted during the period covered by the Workers' Compensation Board award. Except in controverted cases, most restorations will involve only those credits charged during the seven calendar day initial waiting period for employees whose disability extends beyond 14 calendar days. An exception will occur for employees whose absence does not extend beyond 14 calendar days who receive a schedule loss award. Under Workers' Compensation Law, certain disabilities require the employee to receive an award of a specific number of days of compensation (which are listed on a schedule in the Law) without regard to the number of days actually lost from work due to the injury. In the case of a schedule loss award, the employee will have any credits charged during the initial waiting period restored on a prorated basis because New York State will receive a credit for wages paid.

Credits restored cannot be used again in connection with absences attributable to the same accident or injury. When restoration of leave accruals causes the employee to exceed...

...applicable maximums for vacation and/or sick leave, the employee has one year from restoration of credits or return to work, whichever is later, to reduce accruals below applicable maximums. During this period of time, the employee continues to earn vacation and sick leave. There is no restoration of expired personal leave, holiday leave or floating holidays.

Example:

An employee charged 4 days of leave accruals, (3 days of sick leave and 1 day of personal leave) and was granted 1 day of sick leave at half-pay, upon exhaustion of credits, to cover the initial waiting period following a workers' compensation injury.

After the WCB hearing, the C-8 EMP from the SIF detailed a credit to NYS of a total of 5 days (1 week) with a net monetary credit of $300 ($400 minus $100 attorney's fee). The employee's supplement from OSC is $140 per week, so the total on which the prorated restoration of credits is made is $440. The employee's biweekly gross salary is $1800. The basic workweek of this employee is 40 hours.

Summary

- Sick leave hours: 24 hrs used - 11.75 hrs restored

- Personal leave hours: 8 hrs used - 4.00 hrs restored

- Sick leave at half-pay: 1 day used - 1 day restored

Eligibility for Overtime

For purposes of determining whether an employee has met the 40-hour per week threshold for eligibility for overtime compensation, time spent on workers' compensation disability leave with percentage supplement counts as time worked. For example, a 40-hour per week employee who has two days of intermittent workers' compensation disability leave with percentage supplement in a workweek and who works or charges credits for the remaining three days in that workweek is deemed to have met the 40-hour threshold and any additional work performed in that workweek is paid at the overtime rate.

Controverted or Contested Claims

Eligibility for the workers' compensation benefit under the contract is dependent upon the State Insurance Fund/Workers' Compensation Board determination that a disability exists which resulted from an occupational injury or disease. Whenever the SIF controverts a claim (because it is alleged that the injury or disease did not occur on the job or it is alleged that the employee has not suffered any such injury or disease), the employee is not eligible for benefits under the contract.

In the case of a nonwork-related illness or injury, the employee continues to be eligible to use his/her leave credits and to be granted sick leave at half-pay as is the case for any ordinary disability. On the other hand, if the SIF has denied benefits because they believe there is no illness or injury, an employee is expected to be present at work. Any such absence may be considered unauthorized, until such time as the controversy is resolved, if the employee does not, in fact, return to work. Such employee should be placed on leave without pay pending resolution of the claim, return to work or termination pursuant to Civil Service Law, whichever occurs first.

If the controverted claim is resolved in favor of an employee by the Workers' Compensation Board, the SIF must begin making wage...

...replacement payments. The employee, if charging leave accruals because the controversion was based on a nonwork-related illness or injury, would stop charging credits as of the date of notification from the SIF and no longer receive his/her State salary; the agency must file a PR-75 to place the employee on workers' compensation disability leave with percentage supplement effective as soon as possible following notification by the SIF. Any credits (including sick leave at half-pay) used prior to that point for which the Workers' Compensation Board issues a Notice of Decision and New York State receives a credit, will be restored to the employee on a prorated basis. (See Restoring Leave Credits for further information.)

The employee whose case was controverted due to non-disability will, upon a decision of the Workers' Compensation Board which overturns the controversion, have his/her status changed via PR-75 to workers' compensation disability leave with percentage supplement effective as of the first day of leave without pay and the SIF will make wage replacement payments for this period. OSC will also process a supplement if the employee is eligible. The agency will credit the employee with the leave accruals he/she should have earned during this period since the leave without pay is now retroactively corrected to workers' compensation disability leave with percentage supplement.

Section 71 Civil Service Law and Rule 5.9

The Medical Evaluation Program in no way changes the provisions of Civil Service Law. Section 71 of the Civil Service Law provides that an employee who is disabled as the result of an occupational injury or disease is entitled to a leave of absence for a minimum of one cumulative year (365 calendar days) unless found to be permanently disabled.

The cumulative year of mandatory leave includes periods of absence charged to leave credits, periods of workers' compensation disability leave with percentage supplement and periods of leave without pay following the nine cumulative months of benefits. For calculation of the "cumulative year," see page 3 [R-3], of Section 21.8 of the Attendance and Leave Manual.

Employees absent for one cumulative year because of an occupational injury or disease may be continued in employment at the discretion of the appointing authority but are not entitled to be so continued. The benefits provided by the negotiated Medical Evaluation Program (accrual of biweekly leave credits, continuous...

...service credit, retirement service and health insurance benefits) have a nine month cumulative maximum. Employees should be placed on an ordinary leave without pay at the end of that nine month period for the remainder of their absence due to the same injury or disease.

Procedural guidelines for the implementation of Rule 5.9 of the Rules

for the Classified Service, which details the notification and appeal

provisions required by Section 71, are contained in the State Personnel

Management Manual Policy Bulletin #93-02, dated May 12, 1993.

CLAIMS PROCESSING

The injured employee and the supervisor have the first responsibility for reporting the accident to the personnel office or designated agency contact. Appropriate agency forms and an accident investigation must be completed and, upon receipt of this information, the agency should determine if the accident/injury is reportable to the SIF.

The criteria for determining whether an incident/injury is reportable to the SIF are:

- if the incident causes lost time beyond the shift in which it occurred, or

- requires medical treatment beyond first aid, or

- requires more than two medical treatments (including first aid).

If any of these conditions are met, the incident should be reported to the SIF as soon as practicable, but no later than 10 calendar days from the employee's notice of the incident.

Agencies should refer to the SIF Intake Form (see Attachment C) and provide the SIF with all the information contained within that document.

It is imperative that accidents be reported promptly to avoid delays in processing the employee's claim for benefits.

Following the initial telephone or FAX report of the accident the agency must file a C-2 (Employer's Report of Accident/Injury) with the SIF and WCB. Any additional information discovered after the initial report should be forwarded to the S IF as quickly as possible following the normal course of ongoing communication between the agency and SIF concerning the claim.

Medical Documentation

The employee is responsible for ensuring that his/her treating physician submits the necessary medical information to the SIF. Without medical documentation, the SIF cannot process payment to the employee who may have no other source of income. Employees are also expected to comply with agency procedures for submitting medical documentation in addition to their agreement to participate in the Medical Evaluation Program.

The agency is responsible for informing the employee of the need to have his/her physician submit medical documentation to SIF. In addition, the agency should provide SIF with copies of any medical documentation regarding the case which has been submitted to the agency; it should not be assumed that SIF has received copies of such documentation.

Apart from the requirement to share medical documentation with SIF, any medical documentation should be handled consistent with agency policy and practice regarding the confidential treatment of such information.

For purposes of determining eligibility for benefits under the program, SIF makes the final determination regarding what constitutes satisfactory medical documentation. However, nothing in the provisions of this program precludes the agency from requiring that the employee submit periodic medical documentation directly to the agency to substantiate the absence nor is the agency precluded from requiring the employee to undergo a medical examination by a management-selected physician as a condition of return to work.

Agencies should clearly communicate to employees any requirements concerning medical documentation in connection with return to work procedures to prevent delays in employees being able to return as quickly as possible.

Medical Evaluation Process

Every accident on or after July 1, 1993 for which the employee elects the Medical Evaluation Program and has lost time beyond two full workdays after the date of the accident will be reviewed by management for the purpose of determining the need to schedule a medical evaluation. Agencies should request a medical evaluation under any of the following circumstances:

- the initial prognosis indicates that the absence will last beyond 6 weeks. In this case the medical evaluation should be scheduled at about 5 weeks of absence.

- the individual's prognosis indicates that the absence will be less than 6 weeks, but the employee does not return to work on the specified date. The medical evaluation should be scheduled as soon as possible after the employee fails to return.

- whenever management has reason to believe the individual may be eligible for a limited duty assignment because of the nature of the injury and/or the medical information received.

The employing agency will contact the local SIF representative and request a "PS&T Medical Evaluation" whenever it is determined that such an evaluation is needed. The State Insurance Fund has agreed to schedule these examinations within five work days of receiving the request.

The employing agency is expected to provide the SIF with the following documentation in connection with such a request:

- current medical report(s) and C-2, if not already provided.

- current mailing address and telephone number of employee.

- agency contact person and telephone and telefax numbers.

This information should be "faxed" to SIF to avoid delays in scheduling medical examinations.

The SIF will notify the employee and the employer of the date, time and location of the examination. If an employee is unable to attend a scheduled medical examination, he/she is responsible for...

...notifying the employer, in addition to the SIF, and should be so advised at the time the examination is scheduled. SIF will also notify the agency if an employee does not report for a scheduled examination. The agency will advise SIF whether or not the examination should be rescheduled. Employees who do not attend these scheduled medical examinations will be subject to appropriate administrative action.

Reasonable and necessary travel expenses incurred by employees attending these examinations will be paid by SIF in accordance with their normal procedures for travel expense reimbursement. Questions on travel expenses should be directed to the agency's usual SIF contact person.

The medical examination will be detailed enough to allow the evaluating physician to determine the employee's level of disability and prognosis for full recovery. In addition, if the level of disability is found to be at 50 percent or less, the evaluating physician will provide a statement of capabilities/ limitations so that the agency has sufficient information to establish a limited duty assignment for the employee. A copy of the Estimated Physical Capabilities Form to be used for this purpose is attached (Attachment E).

The SIF will make the results of the medical evaluation, including the limitations statement, available to the employer, within two work days of the examination. The evaluating physician's report, including the statement of limitations/capabilities, if prepared, will be provided to the employee's treating physician also.

If the employee is more than 50 percent disabled or more than 45 days from expected full recovery, he/she will continue to receive the leave benefits that are appropriate for his/her length of absence. If the employee is 50 percent or less disabled and within 45 days of full recovery, the employee may request or the agency may require the employee to return to an alternate duty assignment as described beginning on page 27. The alternate duty assignment should be assigned for the duration of the disability or 45 days, whichever is less. Employees who previously were eligible to receive a supplemental payment are no longer eligible since their disability has been established at 50% or less.

Based on the prognosis given by the evaluating physician and such physician's recommendation, periodic reevaluations should be scheduled until such time as the employee is eligible for an alternate duty assignment or fully recovers and is returned to work. Each time such an examination is scheduled, the time frames described above for scheduling and receipt of reports will be applied. The employing agencies are directed to discuss reevaluations with the local SIF representative upon completion of the initial evaluation and at any time they believe such an evaluation is needed.

Communication With the State Insurance Fund

Accurate and timely communication with the State Insurance Fund is the critical link needed for employees to receive benefits under this Program. SIF is now required to make payments to State employees in the PS&T Unit on a current basis in accordance with the Workers' Compensation Law because the employee will not be receiving salary continuation after the first week of absence unless the employee is found eligible for a supplemental payment from OSC. Such supplement cannot be processed, however, until the first SIF payment is made. This is not possible without the information that is supplied by the agency. Agency staff should err on the side of providing too much information rather than too little if there is any doubt as to SIF's need for the information. The SIF must document all the actions taken in connection with a claim and the agency receives copies of each of these forms. The agency is responsible for reviewing these forms and communicating with SIF whenever there is a question about benefits or a change in status which the agency does not understand.

Initial Accident Report

The first piece of information to flow between the agency and SIF is the initial accident report. The employer is required by the New York State Workers' Compensation Law to report accidents within 10 calendar days of the incident or of first learning of the incident. Therefore, agency staff have an obligation to report to SIF within this time frame or possibly be subject to a fine by the Workers' Compensation Board. Aside from this negative action, if the employers' report of injury is not on file, SIF cannot proceed to process the claim which could result in the employee not receiving timely benefits. This lack of timely payment also can lead to a fine by the WCB. The most important reason for timely reporting, however, is to ensure that the injured employee receives benefits from SIF on time so he/she is not without income (since he/she will be off the agency payroll).

Initial accident reporting can be done by telephone or telefax. Attached to this memorandum as Attachment C is the SIF Intake Form that is mentioned under the Reporting Accidents section. (Attachment D is a list of SIF District Offices and the counties each office serves.) This information is needed by SIF to start a claim file. Once the agency accident report has been reviewed and it has been determined that the accident is reportable to SIF, that initial information should be provided to SIF immediately. If there is any issue of reportability, SIF should be contacted for a determination. After the initial contact has been made, the C-2 must be filed with the WCB and SIF within 10 days.

Employee Status Changes

In addition to the initial accident report, all other employee status changes (including address changes) need to be reported to the SIF so that employees receive the correct benefits and are neither underpaid nor overpaid. For example, if the agency does not report that the employee has returned to work, the employee will continue to receive compensation payments from SIF while back on the payroll and receiving regular salary. In the same vein, the employee could be removed from the regular payroll and placed on workers' compensation disability leave with percentage supplement, but not receive benefits from SIF because SIF was not notified of the absence. The SIF will continue to complete the C-11, "Employer's Report of Injured Employee's Change in Employment Status Resulting From Injury," but they must receive notice from the agency of changes so that they can complete and file the form with the WCB.

Medical Reports

The SIF has established procedures to provide medical reports from consultant physicians and the reports under the Medical Evaluation Program to the employer. It is incumbent upon each agency to ensure that any medical documentation they obtain concerning an employee absent due to a workers' compensation disability be shared with the SIF, even in-house clinic reports for agencies with those capabilities. Many times the critical information in determining compensability of a particular absence is the supporting medical documentation. The agency has an obligation to ensure such documentation is made available to the SIF.

Other

In providing information to SIF, agency staff have an obligation to respond to SIF inquiries in a timely and thorough manner. As New York State's representative before the WCB, SIF...

...needs to have complete knowledge of the case. If SIF receives a medical report indicating a work-related disability but has no agency report, they will contact the agency for confirmation that the accident occurred. An agency investigation should be undertaken immediately to ascertain the facts of the case.

SIF Forms

Agency staff's second role in communicating with the SIF is to respond to the information received on the copies they get of the forms SIF is required to file with the WCB. Questions about these forms or their purpose should be directed to SIF. These forms include:

C-6 Notice That the Payment of Compensation Has Begun Without Awaiting Award of the Workers' Compensation Board

C-7 Notice That Right to Compensation is Controverted

C-8 Notice That Payment of Compensation for Disability Has Been Stopped or Modified

C-8EMP Information from C-8 with Details of Employer Reimbursement

C-9 Notice That Right to Compensation is Not Controverted But Payment Has Not Begun

The State Insurance Fund will complete the following forms on behalf of state agencies:

C-11 Employer's Report of Injured Employee's Change in Employment Status Resulting From Injury

C-22b Notice of Intention to Suspend or Reduce the Payment of Compensation After a Direction to Continue Payments

C-240 Employer's Statement of Earnings

C-256.2 Claim for Reimbursement of Wages Paid to State Employees

In summary, agencies should communicate early and often with SIF throughout an employee's absence. They should ensure that SIF knows when the employee is at work or absent and specifically for which days of absence the agency has provided payment or placed the...

...employee on leave without pay. This is necessary so SIF can claim reimbursement for wages paid on behalf of the agency and subsequently credit New York State or pay the employee as appropriate. The agency must respond to information provided by SIF so that an employee's status is changed correctly and the person is not underpaid or overpaid.

Communication With the Employee

The Medical Evaluation Program relies on the employee, agency and SIF all communicating with each other in a timely fashion with accurate and complete information. Unlike benefits under the Supplemental Pay Program, the employee's benefits from SIF are processed on a current basis. It is essential, therefore, that the agency communicate to the employee his/her responsibilities, obtain the information needed for the SIF to process the claim and ensure that the employee receives all the benefits to which he/she is entitled, but no more than the program allows. Refer to the section entitled Communication With the State Insurance Fund for a discussion of the agency's responsibilities to SIF.

After ensuring that the employee receives medical attention as needed, the agency must obtain a completed accident report form from the employee and the supervisor and conduct any investigation deemed appropriate. Once the employee has provided medical documentation, the name, address, and phone number of the attending medical practitioner should be noted in the employee's file.

Although employees are assumed to have selected the Medical Evaluation Program and to have chosen to charge the first five days of absence, agencies must contact each employee regarding his/her options so that time records and payroll transactions for workers' compensation disability leave with percentage supplement can be processed in a timely fashion.

In all communications with the employee it is imperative for the agency to stress that without medical information from the employee's physician, SIF cannot process the claim and begin payments. If the SIF cannot begin payments, the employee will have no other source of income. (Supplemental payments are only made following SIF payments for the same period of disability.)

Throughout the absence, the agency should maintain contact with the employee, including making arrangements for completion of time records, since the employee continues to accrue leave credits during periods of workers' compensation disability leave with...

...percentage supplement. When credits are restored pursuant to a WCB hearing, the employee should be notified. (Refer to Earning of Leave Accruals and Restoring Leave Accruals.)

Before the 21st day of absence the agency must notify the employee of his/her rights pursuant to Rule 5.9 and Section 71 of Civil Service Law. Should the employee not return to duty after an absence of 12 cumulative months, the agency may terminate the employee pursuant to Section 71. The specific notifications required prior to termination under the Rules and Law are detailed in the State Personnel Management Manual Policy Bulletin #93-02, dated May 12, 1993.

Agencies should advise employees of return to work procedures as part of the ongoing contact with the employee.

If the employee's case is controverted by the SIF, the agency must notify the employee to either return to duty (where no disability is found) or obtain necessary medical documentation to support use of leave credits in cases of non-job related disability. The employee must be advised of his/her payroll and leave status in either case. Should the controversion be resolved in the employee's favor, the agency should prepare a memo to the employee and the file which details all necessary adjustments in accruals and changes in status which were processed as a result of the Workers' Compensation Board decision.

Communication with the Office of the State Comptroller

See OSC's Payroll Bulletin, to be issued soon, for a full explanation of the processing of the payroll transactions when removing and adding PS&T Unit employees subject to this Medical Evaluation Program from the payroll. Supplemental payments will be processed following OSC's receipt of information from both SIF and the agency concerning the employee's entitlement to such payments.

Record Keeping

An employee's time record needs to reflect all transactions concerning the employee's absence due to each individual occupational injury or disease. It is recommended that agencies use the SIF case file number or date of accident on time records so that each absence is associated with the appropriate case. This is important not only for payment purposes, but also to calculate the nine months of benefits and one calendar year minimum entitlement to leave available for a single injury or disease and to be able to restore leave credits accurately.