Medicare

Are you becoming eligible for Medicare due to turning 65, disability, or a diagnosis of End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS)? This page has information about how your Medicare benefits will work with your NYSHIP coverage.*

Medicare becomes your primary insurer when you are eligible for Medicare and enrolled in NYSHIP as a retiree, vestee, dependent survivor, or are covered under Preferred List provisions. To coordinate Medicare with your NYSHIP benefits, you should make sure that you:

Contact the Social Security Administration (SSA) to enroll in Medicare three months before your birthday month. Visit https://www.ssa.gov/onlineservices or call 1-800-772-1213.

Enroll in Medicare Parts A and B (be sure not to decline Part B).

If you are eligible for Medicare before age 65, you must notify the Employee Benefits Division that you have enrolled in Medicare Parts A and B, and provide a copy of your Medicare card.

Do not sign up for any non-NYSHIP Medicare Advantage Plan or Part D prescription plan.

To help you remember to enroll in Medicare, NYSHIP will send you a letter and Medicare information packet a few months before your 65th birthday.

*Some people confuse Medicare with Medicaid. Both are administered by the Centers for Medicare and Medicaid Services (CMS). Medicaid is a health insurance program for low-income persons of any age, is jointly funded by federal and state governments, and is usually administered at the county or local level. Medicare is a health insurance program administered by the federal government to individuals over age 65 or who are eligible due to disability.

For more information, see the publication

Medicare and NYSHIP.

Medicare Part D Information

Medicare-primary Empire Plan enrollees and dependents will automatically be enrolled in Empire Plan Medicare Rx, a Medicare Part D prescription drug program with expanded coverage designed especially for Empire Plan members. The Employee Benefits Division is required to send an annual notice of Creditable Coverage for the Medicare Part D Prescription Drug Program to all active and retired NYSHIP enrollees and dependents who are 65 or older, or are eligible for Medicare due to disability. The notice attests to the creditable coverage status of the NYSHIP prescription drug program.

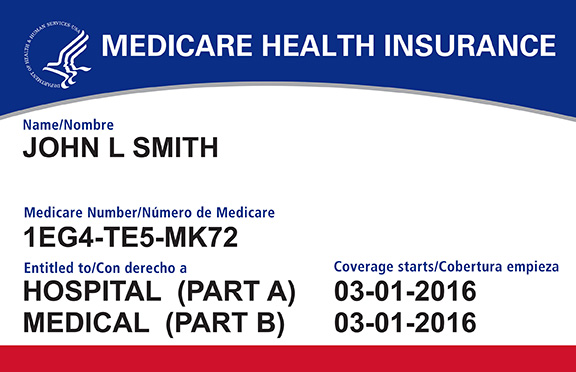

New Medicare ID numbers and cards

In an ongoing effort to fight medical identity theft and fraud, the Centers for Medicare and Medicaid Services (CMS) has been mandated to remove Social Security Numbers (SSNs) from all Medicare cards by April 2019.

New Medicare cards will be mailed to all Medicare enrollees beginning in April 2018. Your new card will have a unique ID called a Medicare Beneficiary Identifier (MBI) that will replace the SSN-based Health Insurance Claim number (HICN) on new Medicare cards.

This will help protect your private health care and financial information, and will be coordinated with the Social Security Administration and with providers. Additionally, the Employee Benefits Division is looking at any impact the new MBI will have for NYSHIP enrollees and will communicate any new information in future Empire Plan Reports.

For more information on the new cards, please visit http://go.medicare.gov/newcard.

Enrolling in Medicare: Frequently Asked Questions (FAQs)

Medicare will be considered your primary coverage and The Empire Plan will be secondary. Your Empire Plan benefits will be coordinated with Medicare through the Crossover program. Make sure you present both your Medicare card and Empire Plan card to your provider. If the provider participates in Medicare and your NYSHIP plan, you are responsible only for your copayment(s), if any. Please see Medicare & NYSHIP for more information about claims coordination.

Empire Plan members will also automatically be enrolled in a Part D prescription drug plan called Empire Plan Medicare Rx. You will receive a new prescription card, but you should not notice a change in your benefits or copays.

It is the combination of coverages under Medicare Parts A and B and NYSHIP that protects you. As secondary payer to Medicare, The Empire Plan will not pay for any expenses that Medicare would pay for. The Empire Plan pays for much of the Medicare Part A and B deductible and coinsurance amounts if you use The Empire Plan provider network, and may pay for some other medical expenses not paid by Medicare. If you cancel your NYSHIP plan, you will not have health insurance that is secondary to Medicare, and you will no longer be reimbursed by NYSHIP for your Medicare Part B premium.

If you or your dependents are not enrolled in Medicare Parts A and B when first eligible, it could be very costly for you. The Empire Plan will not pay for services Medicare would have paid if you had enrolled in Medicare. Additionally, if you do not enroll in Medicare Parts A and B when you are first eligible for primary coverage, you may pay more for Medicare as a penalty for late enrollment. Please refer to Medicare & NYSHIP for more information.

If you are working in a NYSHIP benefits-eligible position, NYSHIP will generally be primary for you as an active employee and, in most cases, for any Medicare-eligible dependents, so you will not be required to have Parts A and B in place. There are exceptions for covered domestic partners and members with ESRD. Please refer to Medicare and NYSHIP for more information.

Medicare will become primary to NYSHIP for you only. Your dependents will still be considered NYSHIP-primary until they qualify for Medicare.

When you are no longer actively employed, Medicare will become primary to NYSHIP for any Medicare-eligible dependents as of their initial eligibility date. Enrollment in Parts A and B is required to maintain coverage under NYSHIP for anyone who is eligible for primary coverage under Medicare.

When you are no longer actively employed, Medicare will become primary to NYSHIP for any Medicare-eligible dependents as of their initial eligibility date. Enrollment in Parts A and B is required to maintain coverage under NYSHIP for anyone who is eligible for primary coverage under Medicare.

If you are covered under another person’s active group employer coverage, generally that coverage is primary before Medicare and your NYSHIP plan. However, if you are covered under another person’s retiree benefits or if you want to maintain your own coverage, you must enroll in Medicare Parts A and B when eligible.

Medicare allows enrollment in only one Medicare product at a time. Be aware that enrolling in a Medicare Part D plan, a Medicare Advantage Plan, or other Medicare product in addition to your NYSHIP coverage may drastically reduce your benefits overall and could lead to the cancellation of your coverage. Please refer to Medicare & NYSHIP for more information or contact the Employee Benefits division at 1-800-833-4344 if you have any questions about how your NYSHIP benefits may be affected by enrolling in another plan.

Medicare Part B Premium Reimbursement

When Medicare is primary to NYSHIP coverage, NYSHIP reimburses you for the standard Medicare Part B premium you pay to SSA, excluding any penalty you may pay for late enrollment.

NYSHIP automatically begins reimbursement for the standard cost of original Medicare Part B when Medicare becomes primary to NYSHIP coverage at age 65 for retirees, vestees, dependent survivors, and enrollees covered under Preferred List provisions, and their dependents who turn 65.

If you receive a pension, any reimbursement for Medicare Part B will be added to your pension check. If you pay your NYSHIP premium by direct payments to the Employee Benefits Division, Medicare Part B reimbursements will be credited toward your monthly NYSHIP premium payments, and if your Medicare reimbursement exceeds your health insurance premium, you will receive a quarterly reimbursement check from the Office of the State Comptroller.

If you have family coverage under NYSHIP, NYSHIP will also reimburse you for the standard Part B premium (and any Part B IRMAA) paid to SSA for any Medicare-primary dependent, provided the dependent is not reimbursed by another source or the premium is not paid by another entity.

Reimbursement is not automatic for any enrollee or covered dependent who is under age 65 and is eligible for Medicare due to disability, ESRD, or ALS. You must notify the Employee Benefits Division in writing and provide a photocopy of your (or your dependent’s) Medicare card to begin the reimbursement in these cases.

Medicare Part B IRMAA (Income-Related Monthly Adjustment Amount)

The Income-Related Monthly Adjustment Amount (IRMAA) is an additional amount that you may be required to pay for your monthly Medicare premiums if you have higher annual earnings.

The Social Security Administration does not notify the Employee Benefits Division when enrollees are required to pay IRMAA. You may contact your local SSA office to verify whether you pay IRMAA by visiting https://www.ssa.gov/onlineservices or call 1-800-772-1213.

The IRMAA amount assessed by SSA for Part D is not reimbursed by NYSHIP.

To be reimbursed for IRMAA, you must complete the IRMAA Reimbursement Request application (below) and submit it to the Employee Benefits Division along with proofs of payment of your Medicare Part B premium.

Please refer to the IRMAA Reimbursement Application instructions for more information.

NYSHIP Publications:

In addition to Medicare & NYSHIP, these publications also address Medicare.

Links and Phone Numbers:

Social Security Administration: 1-800-772-1213, http://www.ssa.gov

Medicare: 1-800-633-4227, http://www.medicare.gov

The Empire Plan: 1-877-769-7447

Empire Plan Medicare Rx: 1-877-769-7449, Option 4

New York State Employee Retirement System: 1-866-805-0990, https://www.osc.state.ny.us/retire

Click here to order a printed copy of the Medicare and NYSHIP booklet with DVD