The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

SEHP15-01

TO: CUNY Health Benefits Administrators

FROM: Employee Benefits Division

SUBJECT: Special Deductions for Summer Coverage

DATE: March 26, 2015

Student Employee Health Plan (SEHP) enrollees who are employed by CUNY and receive their annual salary in less than 26 paychecks must have extra health insurance deductions taken to cover the summer months prior to their removal from the payroll. We will take all summer monies before the employee goes off the payroll. Please refer to the HBA Manual Chapter 6 – Summer Deductions for information on how deductions for summer coverage are taken and other information concerning summer coverage.

If you currently have employees in your agency designated on NYBEAS with a Billing Option for a 20 payroll period schedule, you will be sent a list of those employees in the mail. This information will be used to calculate and deduct the extra summer health insurance premiums. In order to ensure that the information we have is correct, review the list and:

- Process a Billing Option Change transaction to 26P for any employees that are no longer on a 20 payroll schedule, and

- Process a Billing Option Change transaction to 20A for any employee that is eligible for the special summer deductions but were not included on the list.

You must process a NYBEAS Billing Option Change transaction for any SEHP enrollees eligible for the special summer deductions by March 31, 2015. The paychecks impacted by the special deductions will be based on the Billing Option recorded on NYBEAS for each employee; therefore, it is imperative that these indicators be set accurately by the deadlines listed below.

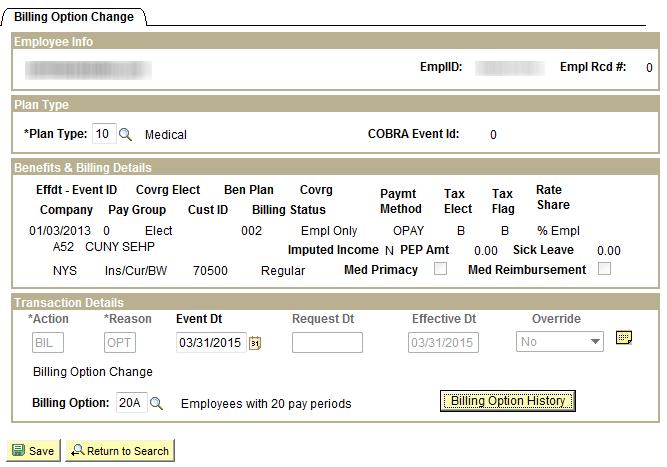

In order to change an employee’s Billing Option in NYBEAS, go to Benefits > Transactions > Billing Option Change, enter the enrollee’s EMPLID and then press Search. Enter Plan Type 10 for Medical, the Event Date, the correct Billing Option and press Save.

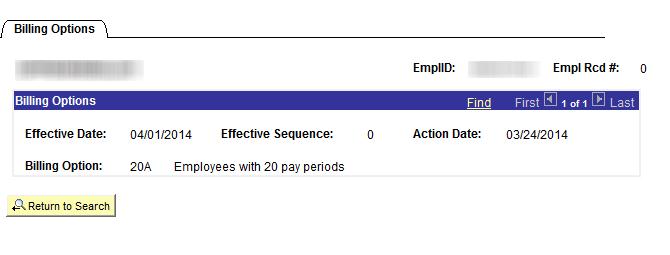

To review a history of an employee’s Billing Options, go to Benefits > History > Billing Options, enter the enrollee’s EMPLID and then press Search.

Below are the dates that billing option changes must be processed by and the paycheck dates that will be affected by the extra deductions.

Institution Current Payroll (CUNY GSEU) – 20 paychecks (20A)

HBA must process all billing option changes by 3/31/15.

|

Paycheck Dates |

Regular Deductions Taken |

Extra Deductions Taken for following Paycheck dates |

|

4/16/15 |

1 Regular deduction |

2 extra deductions for 6/11/15, 6/25/15 |

|

4/30/15 |

1 Regular deduction |

2 extra deductions for 7/9/15, 7/23/15 |

|

5/14/15 |

1 Regular deduction |

2 extra deductions for 8/6/15, 8/20/15 |

|

5/28/15 |

1 Regular deduction |

1 extra deductions for 9/3/15 |

Termination Date

For graduate students who do not return to the payroll in the fall, use 9/3/15 as the “date of event” on the termination transaction.

If you have any questions, please contact the HBA Help Line at 518-474-2780.