The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

ANDREW M. CUOMO

Governor

LOLA W. BRABHAM

Acting Commissioner

NY18-01

TO: New York State Health Benefits Administrators

FROM: Employee Benefits Division

SUBJECT: Paid Family Leave (PFL)

DATE: January 5, 2018

Introduction

Effective January 1, 2018, New York State’s Paid Family Leave (PFL) will provide paid time off to employees who need time away from their jobs to help them bond with a new child, care for a family member with a serious health condition or to assist loved ones when a family member is deployed abroad on active military service.

PFL benefits are available beginning January 1, 2018, for New York State Management/Confidential (M/C) employees. State employees in the Executive Branch who are represented by a union will have access to PFL when the State and their respective union reach an agreement to provide the benefit to their members.

PFL is available for up to eight weeks in 2018. Coverage increases to 10 weeks in 2019 and 12 weeks in 2021. Leave can be taken either all at once or in full-day increments.

Eligibility for PFL

Employees with a regular schedule of 20 or more hours per week are eligible after 26 consecutive weeks of employment. An employee will be considered eligible for PFL once the “Days Credited” field in NYBEAS indicates 175.

If an employee with a regular schedule of 20 or more hours per week is off the payroll for one full payroll period or longer, the employee will be considered to have a break in continuous State employment. If the employee has not previously met the required 175 days of continuous service, this break will result in the “Days Credited” field to restart.

Employees with a regular work schedule of less than 20 hours per week are eligible after 175 days worked. For employees with a regular schedule of less than 20 hours per week, employees are credited for each day worked in a payroll period.

Agencies should provide a PFL waiver form to employees who do not meet eligibility requirements. To process waivers, agencies must obtain the signed waiver and update

PayServ. Refer to Payroll Bulletin 1619 for instructions on how to process an employee’s PFL waiver.

For additional eligibility information, please go to: https://www.ny.gov/new-york-state-paid-family-leave/paid-family-leave-information-employees

Payroll Deductions for PFL

Deductions for eligible M/C employees will begin in the paychecks dated January 4, 2018 (Institution) and January 10, 2018 (Administration).

The 2018 PFL payroll deduction is 0.126% of an employee’s weekly wage, up to the State Average Weekly Wage (SAWW).

Employees can calculate their weekly payroll deduction by visiting, www.ny.gov/PFLcalculator.

Election of PFL Benefits

PFL may be taken on a continuous or periodic basis. When PFL is taken on a periodic basis, it must be used in full day increments. Partial day increments are not permitted.

In the event an employee wishes to take time off to care for a qualifying family member an employee may elect to receive full pay by using accrued and unused vacation, personal, holiday and/or family sick leave available in accordance with the Attendance Rules and FMLA, or to not charge available accrued leave credits and receive the statutory PFL benefits in accordance with the monetary PFL benefits noted above. Time charged to leave accruals will not count against an employee’s annual PFL entitlement.

Interplay of Other Benefits and PFL

PFL provides for the following:

- Prohibition of retaliation against an employee for requesting or receiving PFL benefits;

- Restoration to the same position or a similar position the employee previously held prior to taking PFL; and

- Mandates employers to maintain an employee’s health insurance benefits during the period of PFL, provided the employee pays their share of the premium during the leave.

Additionally, during periods of PFL, employees:

- Continue health insurance at the employee cost of coverage;

- Continue NYSHIP administered Dental and/or Vision coverage at no cost; and

- Are ineligible for STD or LTD benefits under the Income Protection Plan (IPP).

For additional information regarding the interplay of benefits with PFL, please refer to Policy Bulletin 2017-02 from the Attendance and Leave Unit for information about the Attendance Rules and FMLA. Please refer to www.cs.ny.gov/pfl for information about PFL and NYSHIP benefits.

Calculating Average Weekly Wage for Employees On Leave Prior to PFL

Eligible employees may decide to elect PFL after having been off the payroll for some time. When calculating the Average Weekly Wage (AWW) for employees electing PFL, HBAs should look at the previous eight full weeks of wages earned prior to the employee taking a leave of absence. This includes time receiving STD or LTD benefits under IPP.

Time off the payroll should not be used to calculate the AWW, nor should IPP benefits paid to the employee while on STD be factored into the AWW calculation.

NYBEAS Enhancements for PFL

NYBEAS has been enhanced to assist agencies in its administration of PFL. NYBEAS Users will have access to the following information:

- New NYBEAS Action / Reason Codes for employees on PFL

- PFL Employee Eligibility Information

- PFL Payroll Deduction Information

New NYBEAS Action / Reason Code for employees on PFL

Employees who take PFL and are not charging other accruals (vacation, sick, personal or FMLA) must be taken off the payroll through a Leave of Absence / Paid Family Leave (LOA/PFL) transaction. Once the employee returns from the PFL, the employee must be returned to payroll using the Return from Leave) transaction. The Return from Leave transaction depends if you are using PayServ, NYSTEP or NYBEAS.

In PayServ, agencies will use the LOA/PFL and RFL/PFL transactions. In NYBEAS and NYSTEP, will use the LOA/PFL and RFL/RLV (Return from Leave / Reinstate from Leave) transactions.

For agencies who use NYSTEP, NYBEAS will interface with NYSTEP and update the employee job information accordingly. Refer to the PayServ - NYSTEP & NYBEAS Conversion table below to see how PFL transaction will be entered in each system.

PayServ - NYSTEP & NYBEAS Conversion Table

PayServ |

NYSTEP & NYBEAS |

| Leave of Absence – Paid Family Leave LOA / PFL |

Leave of Absence – Paid Family Leave LOA / PFL |

| Return from Leave – Paid Family Leave RFL / PFL |

Return from Leave – Reinstate from Leave RFL / RLV |

For agencies who do not use NYSTEP, agency HBAs are responsible for updating an employee’s PFL status by using Workforce Administration in NYBEAS. Refer to the Workforce Administration table below.

NYBEAS Workforce Administration Transaction Processing

NYBEAS Panel |

Action / Reason |

Description |

Effective Date |

|

Workforce Administration > Job Data |

LOA/PFL |

Employee is off the payroll using PFL benefits | Date employee is using PFL benefits |

|

Workforce Administration > Job Data |

RFL/RLV |

Return the employee to the payroll from PFL benefits. | Date the employee returns to payroll and stops PFL |

PFL Employee Eligibility Information

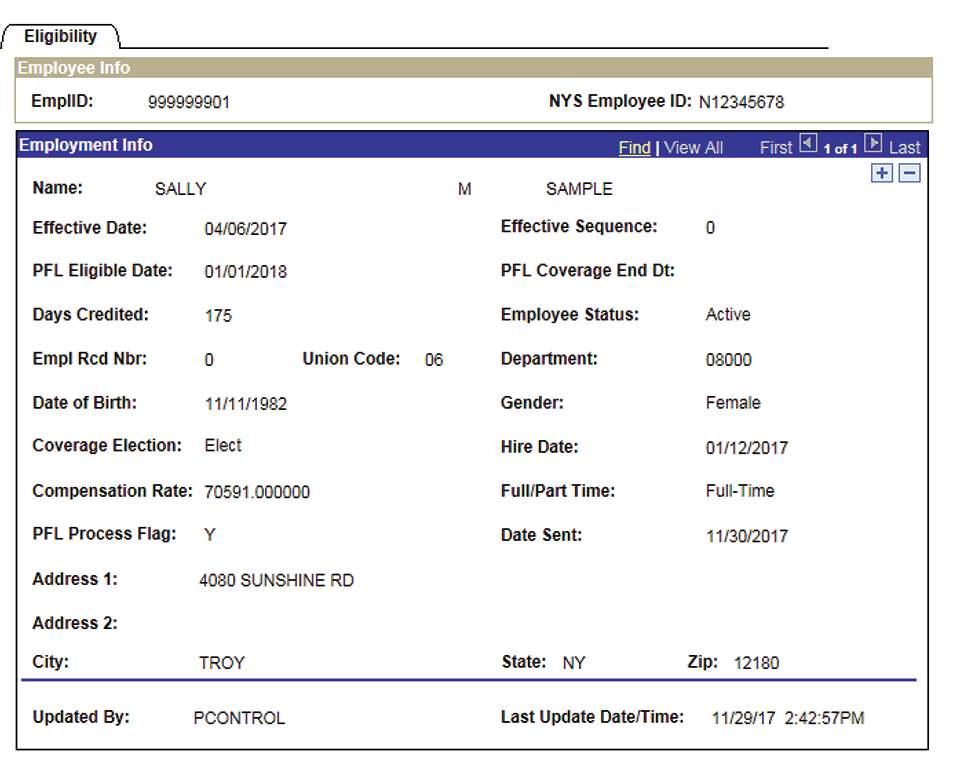

NYBEAS Users will be able to access employee PFL eligibility information by going to NYBEAS > Paid Family Leave > Eligibility.

The PFL Eligibility File page displays an employee’s information as it relates to PFL. In addition to demographic information, the page displays:

- The date an employee is eligible for PFL benefits;

- If the employee filed a PFL waiver and it is processed. The Coverage Election field will display “Waived” if the employee has waived PFL benefits;

- How many days of service an employee has been credited towards their PFL eligibility (employees working 20 or more hours per week must have 175 continuous days of State service to be eligible for PFL, while employees working less than 20 hours per week must have 175 days of State service to be eligible for PFL);

- The date an employee’s PFL coverage ends; and

- Historical PFL information can be viewed by selecting “View All” on the Employment Info banner.

HBAs can use this page to verify an employee is eligible to submit a claim for PFL.

PFL Deduction Information

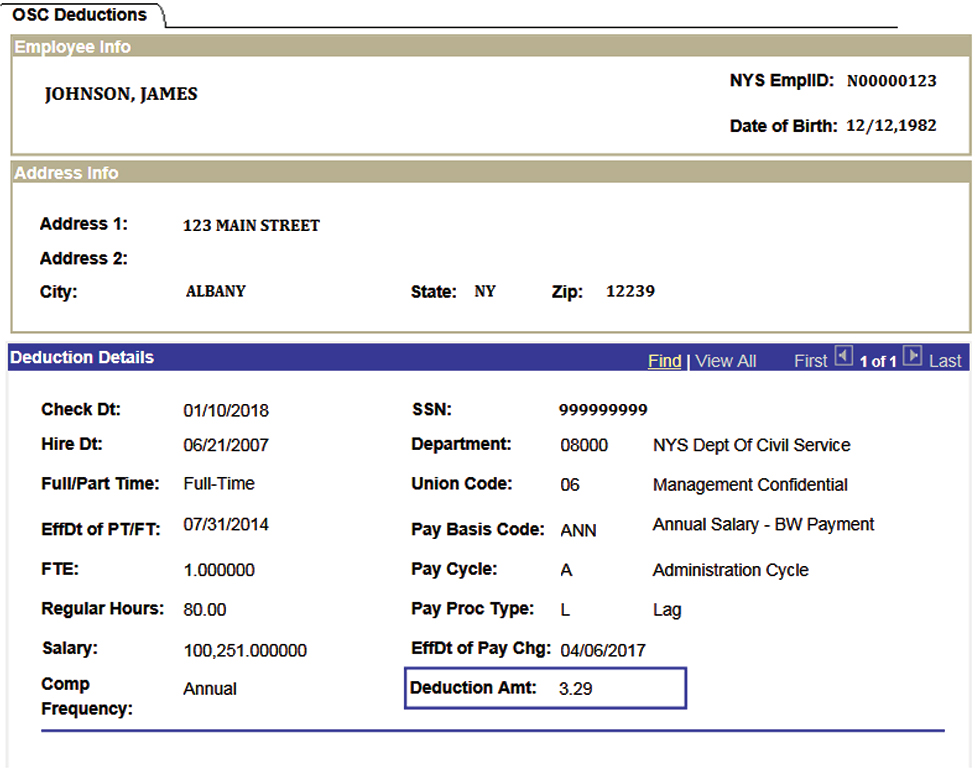

NYBEAS Users will be able to access an employee’s PFL deduction information by going to NYBEAS > Paid Family Leave > OSC Deductions.

The PFL OSC Deductions page displays an employee’s demographic information for PFL. In addition to demographic information, the page displays:

- The Check Date of the payroll deduction;

- The Deduction Amount taken from the employee’s paycheck for the listed Check Date; and

The employee’s PFL OSC Deduction History is captured. For each check an employee receives, the PFL OSC Deductions page will create a record. Users may view PFL OSC Deduction History by selecting “View All” on the Deduction Details banner.

PFL Claims Reporting to Agencies

EBD is working to enhance NYBEAS to provide agencies with a resource to review PFL claim information for their employees. In the interim, EBD work directly with agencies to notify them of employees’ PFL Claims Statistics.

EBD will announce updates to the PFL Claims Reporting process under separate cover.

Recap of PFL Information and Resources

For additional information on PFL benefits for M/C employees, including Frequently Asked Questions and claims forms, visit www.cs.ny.gov/pfl.

Questions regarding PFL absences should be directed to the Attendance and Leave Unit at (518) 457-2295.Questions concerning PFL Eligibility should be directed to the Employee Benefits Division at (518) 549-2027. Questions related to the payment of PFL claims should be directed to MetLife at 1-800-300-4296.

PFL Resources:

Attendance and Leave Manual Policy Bulletin 2017-02

PFL Website: www.ny.gov/PaidFamilyLEave

State Employee PFL Website: https://www.cs.ny.gov/pfl/

December 8 GOER PFL training session: https://bcove.video/2nFKw9z

Questions can be directed to PFL@cs.ny.gov

PFL Helpline: (844) 337-6303