The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

ANDREW M. CUOMO

GOVERNOR

DEPARTMENT OF CIVIL SERVICE

ALBANY, NEW YORK 12239

www.cs.ny.gov

NY11-42

TO: New York State Agency Health Benefits Administrators

FROM: Employee Benefits Division

SUBJECT: 2012 Productivity Enhancement Program (PEP) for Public Employees Federation (PEF) represented employees and employees of the Unified Courts System (UCS) represented by unions other than Civil Service Employees Association (CSEA)

DATE: November 9, 2011

For 2012, the Productivity Enhancement Program (PEP) is available to PEF represented employees and employees of UCS represented by unions other than CSEA. Please note that PEP may become available to other represented employee groups if union contracts are ratified or arbitrated settlements are reached. Information will be provided as soon as it becomes available.

The program allows eligible employees to exchange previously accrued annual leave and/or personal leave, in return for a credit which reduces their share of New York State Health Insurance Program (NYSHIP) premium on a biweekly basis. Since several eligibility variations exist for employees in each of the three branches of State government, a matrix summarizing the differing aspects of the programs is attached to this memorandum.

ELIGIBILITY

To be eligible to enroll in PEP, employees must meet the following criteria:

- Be a NYSHIP enrollee (contract holder) in either the Empire Plan or an HMO at the time of enrollment; and

- Have a minimum combined balance of annual and personal leave after making the forfeiture of at least 8 days for Executive Branch and Legislative Branch employees.

ADDITONAL ELIGIBILITY REQUIREMENTS

PEP

- Be an Executive Branch employee covered by the 2011-2015 New York State/PEF collective bargaining agreement in a title below salary grade 25 or equated to a position below salary grade 25;

- Be an employee of the Unified Courts System (UCS) eligible to participate in PEP in a title at or below jurisdictional grade 23;

All employees must be eligible to receive an employer contribution toward NYSHIP premiums (or be on leave without pay from a position in which the employee is normally eligible for an employer share contribution toward NYSHIP premiums).

Part-Time Employees

Part-time annual-salaried employees who meet these eligibility requirements will be eligible to participate on a prorated basis in accordance with their payroll percentage. Additional hours that these employees work beyond their payroll percentage are not counted for this purpose. In cases where the payroll percentage of these employees results in a leave forfeiture that is not a quarter-hour increment, the leave forfeiture should be rounded to the nearest quarter-hour (rounding up when the resulting figure is exactly between two quarter-hour increments).

Part-time hourly and per diem employees who meet the eligibility requirements may participate on a prorated basis in accordance with their employment percentage.

Voluntary Reduction in Work Schedule (VRWS)

Employees on Voluntary Reduction in Work Schedule (VRWS) agreements who elect to participate in the program do so as full-time employees. If eligible, they exchange the appropriate number of full-time days of annual and/or personal leave for the health insurance premium contribution credit allowable under the program ($500 for the exchange of 3 days or $1,000 for the exchange of 6 days - see Exchanged Leave, below).

Re-employed Retirees

Retired New York State employees who have returned to work must meet all the eligibility criteria for participation in the program and must have the employee share of their NYSHIP health insurance premium deducted from their biweekly paycheck. Re-employed retirees who retain retiree status for health insurance purposes are not eligible to participate.

EXCHANGED LEAVE

Eligible employees have the option to exchange Annual and/or Personal Leave for a credit. There are two options: to exchange three (3) days of Annual and/or Personal Leave for a PEP credit of $500, or to exchange six (6) days of Annual and/or Personal Leave for a PEP credit of $1,000.

Agencies are responsible for distribution and retention of the enrollment forms and for the coordination between the agency personnel office and the HBA, with respect to certification of accrual adjustment(s) and initiating the PEP credit on NYBEAS.

Once enrolled for a program year, employees continue to participate in that year unless they separate from State service, and are not placed in Preferred List status for benefit purposes, or cease to be NYSHIP contract holders. Leave forfeited in association with the program will not be returned, in whole or in part, to employees who cease to be eligible for participation in the program.

PEF-Represented Institution Teachers Eligibility and Exchanged Leave

The eligibility criteria and exchanged leave amounts in the preceding description are amended by the requirements listed below for PEF represented Institution Teachers.

To be eligible to enroll in PEP, PEF-Represented Institution Teachers must:

- Be (1) a classified or unclassified service employee in a title below Salary Grade 25 or equated to a position below Salary Grade 25; or (2) in the unclassified service at the New York State School for the Deaf or the New York State School for the Blind in a title with a full-time annual salary (or in the case of Instructor Assistants, total annual compensation) that does not exceed the job rate in effect at the time of enrollment for an employee in Salary Grade 24 as specified in “Appendix I Salary Schedules” in the 2011-2015 State/PEF Collective Bargaining Agreement;

- Be an employee covered by the 2011-2015 New York State/PEF Collective Bargaining Agreement; and be a NYSHIP enrollee and contract holder in either the Empire Plan or an HMO at the time of enrollment.

Teachers employed by the Department of Correction and Community Supervision, the Office of Children and Family Services, the Office of Mental Health, or the NYS Schools for the Deaf and the Blind (Executive branch) represented by the Public Employees Federation (PEF) may exchange 1, 2, 3, 4, 5 or 6 days of Personal Leave for the PEP credit. In 2012, the credit will be worth up to $166.66 per full day of personal leave forfeited for the program year.

ENROLLMENT PERIOD

The open enrollment period will be November 4, 2011 through December 5, 2011.

Any questions should be directed to your processor.

Health Insurance Premium Contribution Credit for PEP

For the 2012 PEP, the credit that will be applied to the biweekly employee share of the health insurance premium can be calculated as reflected below:

Full-Time Employees

The biweekly credit is equal to $38.46 ($1,000/26 paychecks) or $19.23 ($500/26 paychecks) OR the biweekly cost of the enrollee's employee share of NYSHIP premium, whichever is less.

Part-Time Employees

The biweekly credit is equal to $38.46 or $19.23 multiplied by the employee's payroll/employment percentage OR the biweekly cost of the enrollee's employee share NYSHIP premium, whichever is less.

Institution (PEF) Teachers

The biweekly credit is equal to $6.41 per day forfeited OR the biweekly cost of the enrollee's employee share NYSHIP premium, whichever is less.

The amount of biweekly credit will only be adjusted if the enrollee moves from individual to family coverage during the program year. For example:

Blue Choice (066) for CSEA and M/C Executive and Legislative Branch Employees

Employee in a position, or a position equated to, SG-9 and below:

Individual Premium (2011) - $25.54

Family Premium (2011) - $104.92

Calculated PEP credit - $38.46

An enrollee with individual coverage with Blue Choice Health Plan, option 066, would get a PEP credit of $25.54, not the maximum credit of $38.46. If that enrollee changes to family coverage, the credit would increase to $38.46.

NYBEAS PROCESSING

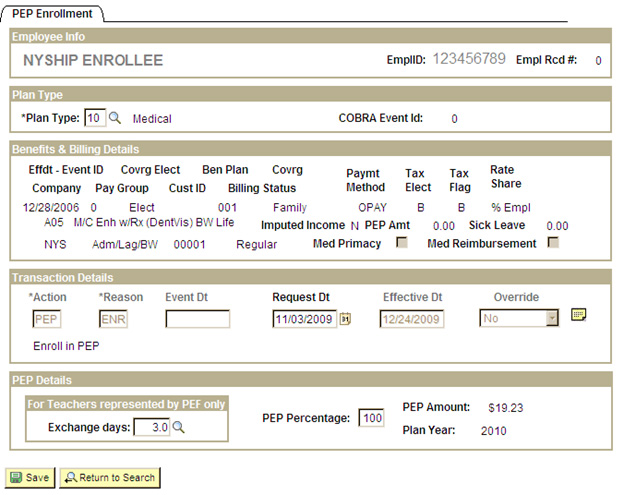

To ENTER the Health Insurance Premium Contribution Credit for PEP

The HBA will process a PEP/ENR to enter the premium contribution credit to NYBEAS for PEP (see below). This transaction is part of the PEP enrollment panel. The credit will show on the enrollee's billing record as a premium credit.

- Follow the NYBEAS Navigation Menu links:

Benefits > Transactions > PEP > PEP Enrollment

- An input screen will display. Enter the enrollee's identification number in the search dialog box and click the search button.

- In the Plan Type field, enter 10 (for Medical). Press Tab.

- The Action and Reason fields will automatically populate (PEP/ENR).

- In the Request Dt field, enter the date of signature on the PEP enrollment form. The date should be November 4, 2011 through December 5, 2011 for all eligible employees. Press Tab.

- In the PEP Percentage field type the employee's payroll/employment percentage. Click Save. (The default is 100%)

- If the enrollee is a PEF Teacher you should enter 1, 2, 3, 4, 5, or 6 days in the Exchange days field of the PEP Details section of the PEP enrollment form. (The default is 3 days) This is only to be used for teachers represented by PEF.

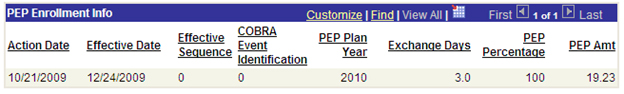

To view the PEP percentage, follow the NYBEAS Navigation Menu links:

Benefits > History > PEP > Enrollment Inquiry

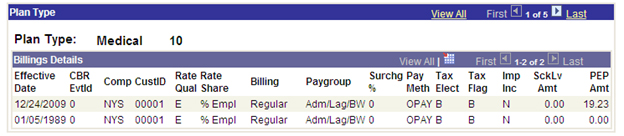

To view the PEP credit calculated, follow the NYBEAS Navigation Menu links:

Benefits > History > NYBEAS Update History and click on the Billings tab.

To view the actual PEP credit applied, follow the NYBEAS Navigation Path links:

Benefits > History > NYBEAS Update History and click on the Accounting tab.

Note: The actual PEP credit applied will be the lesser of the calculated amount or the enrollee's health insurance premium.

Timing of NYBEAS Processing

Since the transaction cannot be keyed until after the certification of the accrual adjustment, coordination with your agency's personnel/payroll staff who handles this is the key to PEP credit processing. The following chart indicates the dates to key the transaction and the corresponding paycheck which will be impacted. Be prepared to answer questions once the employee's paycheck has been affected.

This panel will be open for NYBEAS keying until January 11, 2012.

| Employee's Payroll Cycle | NYBEAS Keying Window | Impacted Paycheck | Paychecks credited with PEP Credit | # of Retro PEP Credits |

|---|---|---|---|---|

| Administration Lag | 11/01/11 - 12/20/11 | 01/04/2012 | 01/04/12 - 12/19/12 | 0 |

| Administration Current | 11/01/11 - 12/06/11 | 12/21/2011 | 12/21/11 - 12/05/12 | 0 |

| Institution Lag | 11/01/11 - 12/13/11 | 12/29/2011 | 12/29/11 - 12/13/12 | 0 |

| Institution Current | 11/01/11 - 11/29/11 | 12/15/2011 | 12/15/11 - 11/29/12 | 0 |

| Triple Lag | 11/01/11 - 12/27/11 | 01/12/2012 | 01/12/12 - 12/27/12 | 0 |

| Employee's Payroll Cycle | NYBEAS Keying Window | Impacted Paycheck | Paychecks credited with PEP Credit | # of Retro PEP Credits |

| Administration Lag | 12/21/11 - 01/03/12 | 01/18/2012 | 01/18/12 - 12/19/12 | 1 |

| Administration Current | 12/07/11 - 12/20/11 | 01/04/2012 | 01/04/12 - 12/05/12 | 1 |

| Institution Lag | 12/14/11 - 12/27/11 | 01/12/2012 | 01/12/12 - 12/13/12 | 1 |

| Institution Current | 11/30/11 - 12/13/11 | 12/29/2011 | 12/29/11 - 11/29/12 | 1 |

| Triple Lag | 12/28/11 - 01/10/12 | 01/26/2012 | 01/26/12 - 12/27/12 | 1 |

| Employee's Payroll Cycle | NYBEAS Keying Window | Impacted Paycheck | Paychecks credited with PEP Credit | # of Retro PEP Credits |

| Administration Lag | 01/04/12 - 01/17/12 | 02/01/2012 | 02/01/12 - 12/19/12 | 2 |

| Administration Current | 12/21/11 - 01/03/12 | 01/18/2012 | 01/18/12 - 12/05/12 | 2 |

| Institution Lag | 12/28/11 - 01/10/12 | 01/26/2012 | 01/26/12 - 12/13/12 | 2 |

| Institution Current | 12/14/11 - 12/27/11 | 01/12/2012 | 01/12/12 - 11/29/12 | 2 |

| Triple Lag | 01/11/12 - 01/24/12 | 02/09/2012 | 02/09/12 - 12/27/12 | 2 |

Timing of 2012 PEP Credit with 2012 Health Insurance Premium Deduction

For employees on Administration payrolls (except Administration Lag employees), the 2012 PEP credit will begin one payroll period prior to the start of the 2012 health insurance premium deduction. All employees will still have 26 paychecks credited with the 2012 PEP credit. Assuming no retroactivity, the following chart indicates the start of the 2012 PEP credits and health insurance deductions for the various payrolls.

|

Employee's Payroll Cycle |

First Check with 2012 PEP Credit |

First Check with 2012 Health Insurance Premium Deduction |

|

Administration Lag |

1/4/2012 |

1/4/2012 |

|

Administration Current |

12/21/2011 |

12/21/2011 |

|

Institution Lag |

12/29/2011 |

12/29/2011 |

|

Institution Current |

12/15/2011 |

12/15/2011 |

|

Triple Lag |

1/12/2012 |

1/12/2012 |

Please note: Due to the way payroll dates fell this calendar year, the last date for employees in the Administration Lag payroll cycle to receive the 2011 PEP credit is their December 7, 2011 paycheck. The first paycheck for these employees to receive the 2012 PEP credit is the January 4, 2012 paycheck. This means that Administration Lag payroll cycle employees will have a paycheck on December 21, 2011 without any PEP credit.