The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

ANDREW M. CUOMO

GOVERNOR

DEPARTMENT OF CIVIL SERVICE

ALBANY, NEW YORK 12239

www.cs.ny.gov

NY12-01

TO: NYS Health Benefits Administrators

FROM: Employee Benefits Division

SUBJECT: OSC Salary Inquiry Page and Contribution Rate Change Transaction

DATE: January 4, 2012

Recently, employees of certain New York State represented groups reached agreement regarding premium contribution rate changes for enrollees participating in the New York State Health Insurance Program (NYSHIP). As a result of these agreements, Health Benefits Administrators (HBAs) will be provided access to a new inquiry page and transaction panel in the New York State Benefits Eligibility and Accounting System (NYBEAS). The purpose of this memo is to explain the inquiry page and the transaction panel and to provide you with instructions for their use.

In order to implement and accurately calculate premium contribution rate changes that are dependent upon employee salary grade or an equivalent value, it is now necessary to capture salary information on NYBEAS. As such, a new inquiry panel and a new transaction panel have been created for this purpose.

- OSC Salary Grade History inquiry panel.

- Contribution Rate Change panel.

OSC Salary Inquiry Panel

Benefits → History → OSC Salary Grade Inquiry

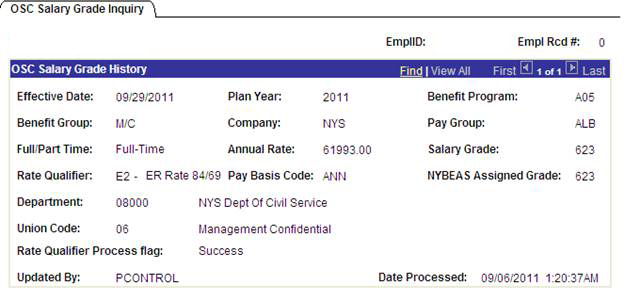

For active employees impacted by the premium rate contribution change, the rate qualifier has been set to E1 (less then salary grade 10) or E2 (salary grade 10 or higher) based upon their salary/and or grade as reported by OSC. The OSC Salary Grade Inquiry Panel was created so that HBAs could view the data provided in determining employee rate qualifiers. This panel also indicates how the information was updated. If the panel indicates "Updated by: PCONTROL", the data was provided by OSC.

The OSC Salary Inquiry Panel is displayed below:

This panel is updated via two methods a?? either through an initial/annual update from PaySERV, or manually through the Contribution Rate Change transaction.

Contribution Rate Change transaction panel

Benefits → Transactions → Contribution Rate Change

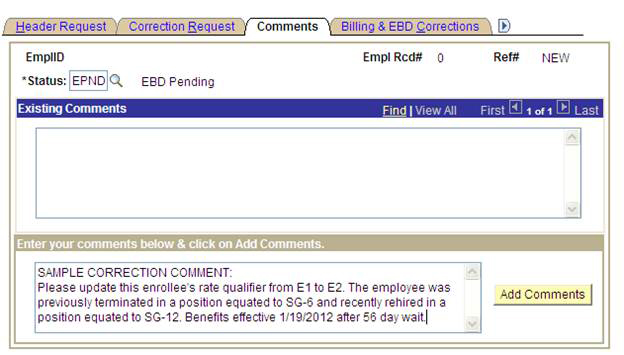

The contribution rate change transaction provides you with the ability to ADD a rate qualifier to an enrollee's file if one does not exist. If an existing rate qualifier requires update, a correction request will need to be submitted to EBD. The request to update this transaction will be described in the Comments panel of the Correction Request.

There are primarily three instances in which you may be prompted to process a contribution rate change to an enrollee:

- Entering a new hire into NYBEAS

- An enrollee changes from a bargaining unit which does not require a rate qualifier to a bargaining unit that does require a rate qualifier

- An enrollee returning to active status from leave

- Example: A CSEA represented employee was in a Leave without Pay (LWOP) status on 9/29/2011 when their E1 rate qualifier was programmatically implemented, and therefore did not receive the appropriate E1 rate qualifier. When the employee returns to the payroll in December 2, NYBEAS will prompt the HBA for the appropriate rate qualifier to be processed.

The salary information that is available in NYBEAS will be updated annually. Outside of the previously mentioned scenarios, any mid-year change to an employee's position will be handled during the annual salary update, which will use salary data in effect on PayServ at the time of the update. Requests to change the mid-year rate qualifier outside of the previously mentioned scenarios will not be processed.

For example, if a CSEA SG-9 employee receives a promotion to SG-11 in February, the employee's NYBEAS record would indicate the E1 rate qualifier until the Annual Update of OSC Salary grade from PaySERV, which would then change the record to indicate the E2 rate qualifier

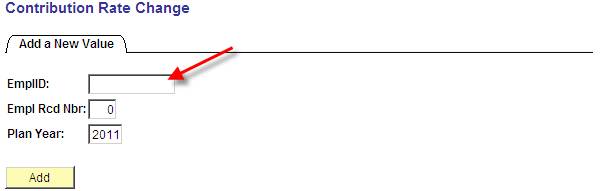

If you are prompted to process a contribution rate change, the following steps should be taken:

- Navigate to Benefits → Transactions → Contribution Rate Change

You will see the following screen where you will enter the employee's Emplid and click on the ADD button

Note: You can only add a rate qualifier if one does not exist. If a rate qualifier already exists you will be instructed to contact EBD to make the change.

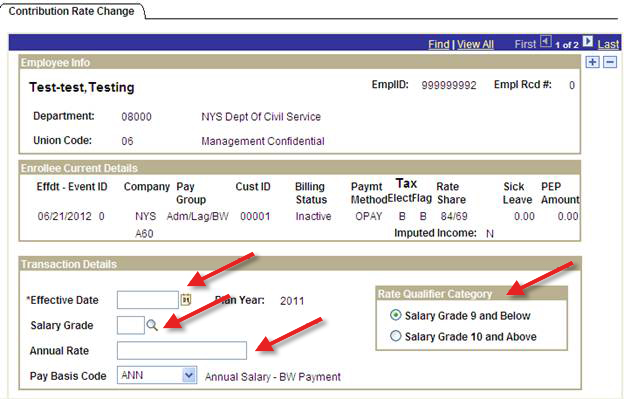

The following screen will be displayed:

- You will be required to complete each area where a red arrow indicates, as shown above.

The Effective Date coincides with the Effective Date Rules and Waiting Periods as indicated in the NYS HBA Manual. To assist you, refer to the following table of common examples:

Employment Event

Employee Group

Payroll Cycle

Date of Employment Event

Effective Date for Contribution Rate Change Transaction

Effective Date of Active Benefits

Hire or Rehire

CSEA

ALB

1/2/2012

2/13/2012

2/13/2012

Return from Leave

M/C

ILB

12/22/2011

1/12/2012

1/12/2012

Transfer (Not PE to NYS)

PEF

ACB

12/15/2011

1/19/2012

1/19/2012

The Annual Rate is the annualized rate of the employee. For certain hourly employees, the hourly wage is multiplied by 2,088 hours to compute the annualized rate for the employee.

The Rate Qualifier Category dictates what rate qualifier will be placed on the enrollee's file the date of the Effective Date.

For employees who are non-salaried graded (NS), the rate qualifier category is based upon their Annual Rate. For employees whose annualized salary is equal to or less than $40,136, the E1 rate qualifier applies. For employees whose annualized salary is greater than $40,136 the E2 rate qualifier applies. Note: that salary amount will change in accordance with changes in salary schedules.

Additionally, keep in mind that an annualized salary for a part-time employee is calculated as if they were full-time. For example, if an employee will earn $25,000 but is working 50% (or .50 FTE), their annualized salary is $50,000.

- Once you've entered the information, remember to Save your transaction.

To ensure data integrity within NYBEAS, HBAs will have limited permissions for the Contribution Rate Change transaction, which will only allow them to add a new rate qualifier if there was no existing rate qualifier information. If there is an existing rate qualifier on the enrollee's file, and it needs to be adjusted, the HBA must contact EBD via the Correction Request process to request the rate qualifier change.