The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

ANDREW M. CUOMO

GOVERNOR

DEPARTMENT OF CIVIL SERVICE

ALBANY, NEW YORK 12239

www.cs.ny.gov

JERRY BOONE

COMMISSIONER

NY12-37

PE12-27

SEHP12-08

TO: New York State and Participating Employer Health Benefits Administrators

FROM: Employee Benefits Division

SUBJECT: New York State Benefits Eligibility and Accounting System Transaction related to Imputed Income

DATE: November 5, 2012

The New York State Benefits Eligibility and Accounting System (NYBEAS) has been updated to integrate PaySERV payroll codes to properly track and report biweekly imputed income amounts for enrollees covering same-sex spouses.

For additional information regarding these payroll codes, please refer to Payroll Bulletin No. 1100 issued by the Office of the New York State Comptroller. For additional background information, please refer to HBA Memo NY11-21, PE11-20, SEHP11-07.

Please refer to the following information for processing instructions relative to enrollments of same-sex spouses.

How to remove imputed income for NYS tax purposes ONLY for enrollees covering their same-sex spouse on NYSHIP

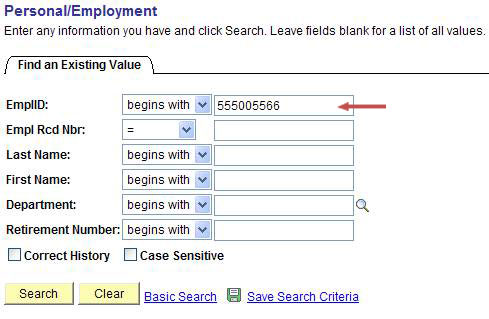

1. Go to Benefits -> Transactions -> Personal / Employment

2. Enter the enrollee's EmplID

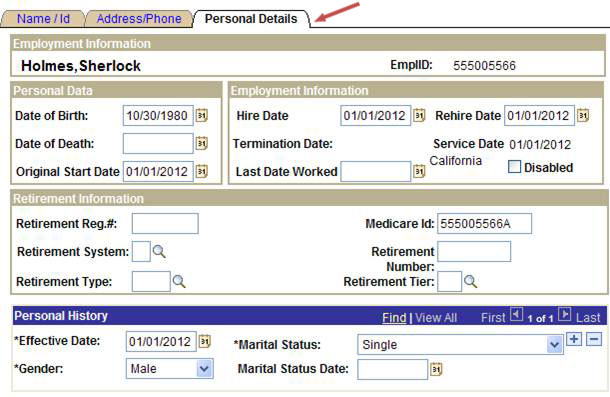

3. Select the tab titled Personal Details

4. Verify the Marital Status is Married. The transaction will not save if both the enrollee and spouse's marital status are not set to Married.

5. If the enrollee's marital status is not set to married, you have to hit the ![]() , and enter a new row of information. Keep in mind the Effective Date on the Personal History row defaults to today's date; please update with the appropriate date. Be sure to verify Gender is correct, change the Marital Status to Married and the Marital Status Date to the date on the marriage certificate.

, and enter a new row of information. Keep in mind the Effective Date on the Personal History row defaults to today's date; please update with the appropriate date. Be sure to verify Gender is correct, change the Marital Status to Married and the Marital Status Date to the date on the marriage certificate.

a. Example: If you are updating information for a new employee and they have been married prior to being hired with your agency, the effective date should be before or equal to the date benefits would go into effect.

b. Example: If you are updating information for an employee who has newly married, the effective date should equal the marital status date.

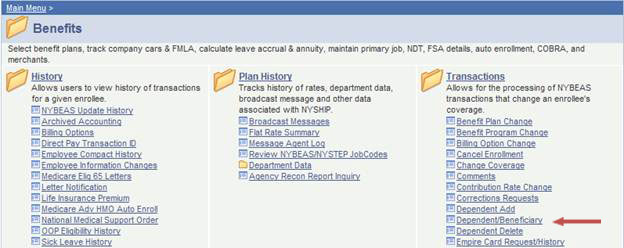

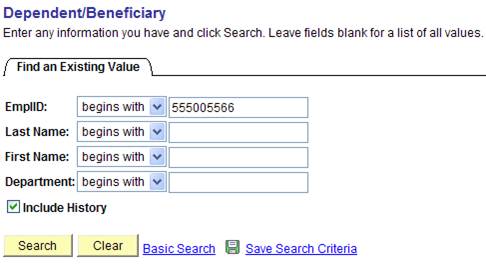

6. Verify the Marital Status of the dependent. Go to Benefits -> Transactions -> Dependent/Beneficiary.

(Please note not all HBA's screen may look identical as the one displayed above.)

7. Enter the enrollee's EmplID.

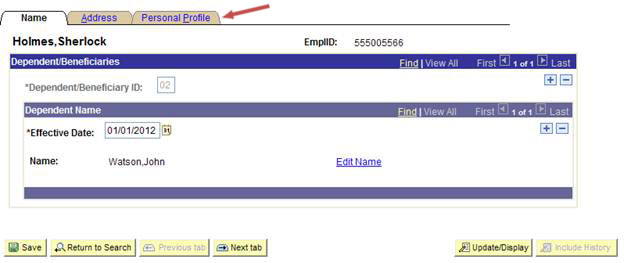

8. Select the Personal Profile tab.

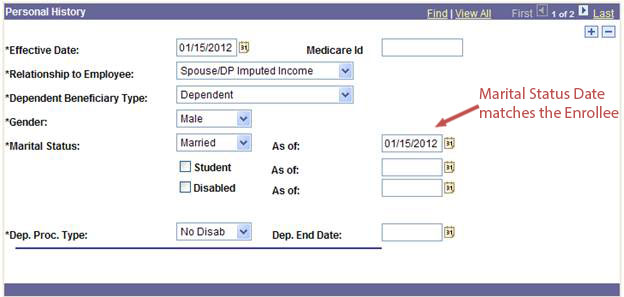

9. Verify the following sets of information.

a. Relationship to Employee = Spouse/DP Imputed Income

b. Gender = same gender as the enrollee

c. Marital Status = Married

d. Marital Status Date = the same Marital Status Date on the marriage certificate, and the same date used for the enrollee.

10. If the Personal History needs to be updated, make sure to hit the ![]() and update the information with the appropriate effective date.

and update the information with the appropriate effective date.

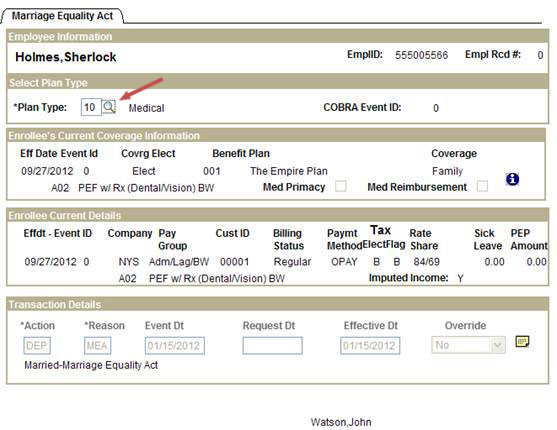

11. After verifying the information for both the enrollee and their spouse, now go to: Benefits -> Transactions ->Married-Marriage Equality Act.

12. Enter the enrollee's EmplID.

13. Enter the plan type of "10" for Medical coverage.

14. Don't forget to ![]() the transaction!

the transaction!

15. Now process for plan type 11 (Dental) and/or 14 (Vision), if the spouse is covered as a dependent for Dental and/or Vision coverage through NYSHIP.

How to verify the imputed income for NYS and Federal Tax Purposes

1. After processing the transaction, the next day you can verify the billing is accurate. Go to Benefits -> History -> NYBEAS Update History and select the Accounting page.

![]()

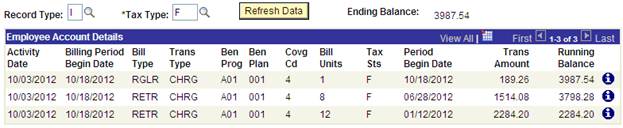

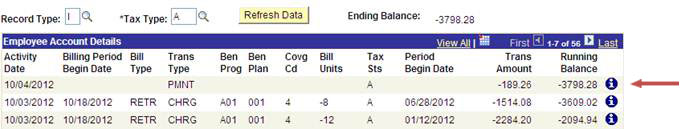

2. When using the Accounting page, change the Record type to "I" and Tax Type to "A" to verify the Imputed Income for NYS tax purposes has been reversed and is no longer being assessed.

In the example below, note the removal of imputed income for the 2012 tax year.

3. To verify Imputed Income for Federal Tax purposes only, change the Record type to "I" and Tax Type to "F".