The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

ANDREW M. CUOMO

GOVERNOR

DEPARTMENT OF CIVIL SERVICE

ALBANY, NEW YORK 12239

www.cs.ny.gov

JERRY BOONE

COMMISSIONER

NY12-39

TO: New York State Agency Health Benefits Administrators

FROM: Employee Benefits Division

SUBJECT: 2013 Productivity Enhancement Program (PEP)

DATE: November 5, 2012

For 2013, the Productivity Enhancement Program (PEP) is available to employees represented by CSEA and PEF, Management/Confidential employees and Legislative and Judicial Branch employees. Please note that PEP may become available to other represented employee groups if union contracts are ratified or arbitrated settlements are reached. Information will be provided as soon as it becomes available.

The program allows eligible employees to exchange previously accrued annual leave and/or personal leave, in return for a credit which reduces their share of New York State Health Insurance Program (NYSHIP) premium on a biweekly basis.

ELIGIBILITY

To be eligible to enroll in PEP, employees must meet the following criteria:

- Be a NYSHIP enrollee (contract holder) in either The Empire Plan or an HMO at the time of enrollment; and

- Have a minimum combined balance of annual and/or personal leave after making the forfeiture of at least 8 days for Executive Branch and Legislative Branch employees.

ADDITONAL ELIGIBILITY REQUIREMENTS

- Be an Executive Branch employee in a negotiating unit that has an agreement/award with New York State effective October 1, 2011 or later in a title equated to salary grade 24 or below. Refer to the Attendance & Leave Bulletin and form for details.

- Be an Executive Branch employee who is unrepresented in a title equated to salary grade 23 or below.

- Be a Legislative Branch annual salaried employee with a salary at or below $77,454.

- Be an employee of the Unified Courts System (UCS) eligible to participate in PEP in a title at or below jurisdictional grade 23. Refer to the UCS PEP memos & forms for details.

- Be a SUNY Management Confidential employee (bargaining unit 13) with a salary at or below$77,454.A Refer to SUNY memos & forms for details.

All employees must be eligible to receive an employer contribution toward NYSHIP premiums (or be on leave without pay from a position in which the employee is normally eligible for an employer share contribution toward NYSHIP premiums).

Part-Time Employees

Part-time annual-salaried employees who meet these eligibility requirements will be eligible to participate on a prorated basis in accordance with their payroll percentage. Additional hours that these employees work beyond their payroll percentage are not counted for this purpose. In cases where the payroll percentage of these employees results in a leave forfeiture that is not a quarter-hour increment, the leave forfeiture should be rounded to the nearest quarter-hour (rounding up when the resulting figure is exactly between two quarter-hour increments).

Part-time hourly and per diem employees who meet the eligibility requirements may participate on a prorated basis in accordance with their employment percentage.

Voluntary Reduction in Work Schedule (VRWS)

Employees on Voluntary Reduction in Work Schedule (VRWS) agreements who elect to participate in the program do so as full-time employees. If eligible, they exchange the appropriate number of full-time days of annual and/or personal leave for the health insurance premium contribution credit allowable under the program. Refer to the appropriate group and SG noted in chart below. A

Re-employed Retirees

Retired New York State employees who have returned to work must meet all the eligibility criteria for participation in the program and must have the employee share of their NYSHIP health insurance premium deducted from their biweekly paycheck. Re-employed retirees who retain retiree status for health insurance purposes are not eligible to participate.

Health Insurance Premium Contribution Credit for PEP

For the 2013 PEP, the credit that will be applied to the biweekly employee share of the health insurance premium is reflected in the charts below according to Salary grade:

Eligible CSEA, PEF, Management/Confidential, Judicial Branch employees and Legislative branch employees.

Full-time employees in a position at or equated to Salary Grade 17 and below (Legislative Branch employees with a salary at or below $59,312):

|

Forfeited Days |

NYSHIP Credit |

Bi-weekly Credit |

|

3 |

$500 |

$19.23 |

|

6 |

$1000 |

$38.46 |

Full-time employees in a position at or equated to Salary Grade 18 through 24 (Legislative Branch employees with a salary no less than $59,312 and no greater than $77, 454):

|

Forfeited Days |

NYSHIP Credit |

Bi-weekly Credit |

|

2.25 |

$500.00 |

$19.23 |

|

4.5 |

$1,000.00 |

$38.46 |

PEF-Represented Institution Teachers Eligibility and Exchanged Leave

The eligibility criteria and exchanged leave amounts in the preceding description are amended by the requirements listed below for PEF represented Institution Teachers.

To be eligible to enroll in PEP, PEF-Represented Institution Teachers must:

- Be (1) a classified or unclassified service employee in a title equated to or below Salary Grade 24; or (2) in the unclassified service at the New York State School for the Deaf or the New York State School for the Blind in a title with a full-time annual salary (or in the case of Instructor Assistants, total annual compensation) that does not exceed the job rate in effect at the time of enrollment for an employee in Salary Grade 24 as specified in "Appendix I Salary Schedules" in the 2011-2015 State/PEF Collective Bargaining Agreement;

- Be an employee covered by the 2011-2015 New York State/PEF Collective Bargaining Agreement; and be a NYSHIP enrollee and contract holder in either The Empire Plan or an HMO at the time of enrollment.

Teachers employed by the Department of Correction and Community Supervision, the Office of Children and Family Services, the Office of Mental Health, or the NYS Schools for the Deaf and the Blind (Executive branch) represented by the Public Employees Federation (PEF) may choose one of the following forfeited leave options specific to Salary grade level for the program year:

PEF Institution Teachers in a position at or equated to Salary Grade 17 and below:

|

Forfeited Days |

NYSHIP Credit |

Bi-weekly Credit |

|

1 |

$166.66 |

$6.41 |

|

2 |

$333.32 |

$12.78 |

|

3 |

$499.98 |

$19.23 |

|

4 |

$666.64 |

$25.34 |

|

5 |

$833.30 |

$32.05 |

|

6 |

$999.96 |

$38.46 |

PEF Institution Teachers in a position at or equated to Salary Grade 18 through 24 may choose one of the following g options:

|

Option |

Forfeited Days January 1, 2013 - March 31, 2013 |

Forfeited Days April 1, 2013 - December 31, 2013 |

Total Days |

NYSHIP Credit |

Bi-weekly Credit |

|

1 |

1 |

1 |

2 |

$416.66 |

$16.03 |

|

2 |

1.5 |

1 |

2.5 |

$500.00 |

$19.23 |

|

3 |

1 |

2 |

3 |

$666.66 |

$25.64 |

|

4 |

1.5 |

2 |

3.5 |

$750.00 |

$28.85 |

|

5 |

1 |

3 |

4 |

$916.66 |

$35.26 |

|

6 |

1.5 |

3 |

4.5 |

$1,000.00 |

$38.46 |

Agencies are responsible for distribution and retention of the enrollment forms and for the coordination between the agency personnel office and the HBA, with respect to certification of accrual adjustment(s) and initiating the PEP credit on NYBEAS.

Once enrolled for a program year, employees continue to participate in that year unless they separate from State service, and are not placed in Preferred List status for benefit purposes, or cease to be NYSHIP contract holders. Leave forfeited in association with the program will not be returned, in whole or in part, to employees who cease to be eligible for participation in the program.

ENROLLMENT PERIOD

The open enrollment period will be October 22, 2012 and November 30, 2012.

Health Insurance Premium Contribution Credit for PEP

For the 2013 PEP, the credit that will be applied to the biweekly employee share of the health insurance premium can be calculated as reflected below:

Full-Time Employees

The biweekly credit is equal to the NYSHIP credit amount reflected in the above chart, OR the biweekly cost of the enrollee's employee share of NYSHIP premium, whichever is less.

Part-Time Employees

The biweekly credit is equal to the NYSHIP credit amount reflected in the above chart multiplied by the employee's payroll/employment percentage OR the biweekly cost of the enrollee's employee share NYSHIP premium, whichever is less.

Institution (PEF) Teachers

The biweekly credit is equal to $6.41 per day forfeited OR the biweekly cost of the enrollee's employee share NYSHIP premium, whichever is less.

Note: The amount of biweekly credit will only be adjusted if the enrollee moves from individual coverage to family coverage during the program year.

NYBEAS PROCESSING

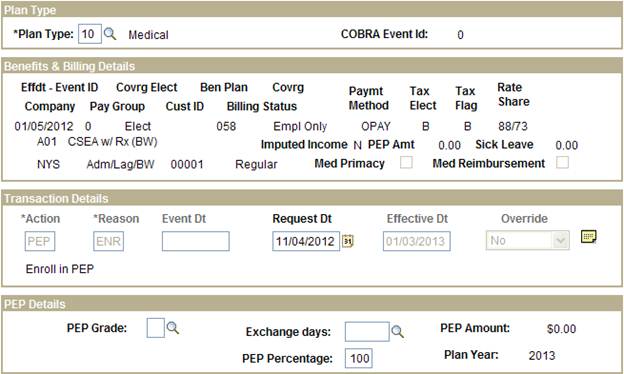

To ENTER the Health Insurance Premium Contribution Credit for PEP

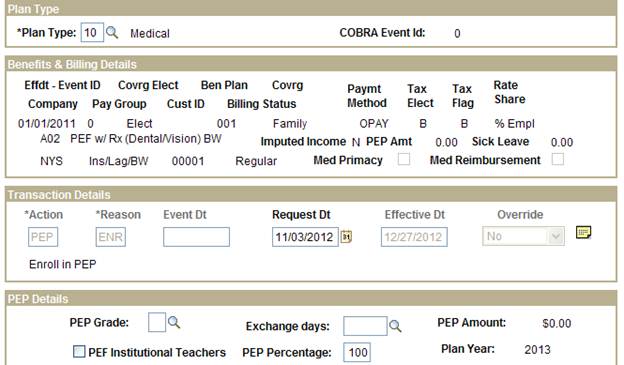

The HBA will process a PEP/ENR to enter the premium contribution credit to NYBEAS for PEP (see below). This transaction is part of the PEP enrollment panel. The credit will show on the enrollee's billing record as a premium credit.

- Follow the NYBEAS Navigation Menu links:

Benefits > Transactions > PEP > PEP Enrollment

- An input screen will display. Enter the enrollee's identification number in the search dialog box and click the search button.

- In the Plan Type field, enter 10 (for Medical). Press Tab.

- The Action and Reason fields will automatically populate (PEP/ENR).

- In the Request Dt field, enter the date of signature on the PEP enrollment form. The date should be October 22 2012 - November 30, 2012 for all eligible employees. Press Tab.

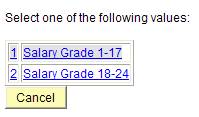

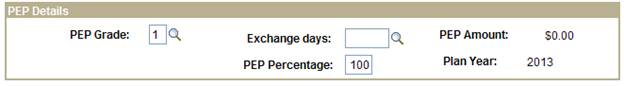

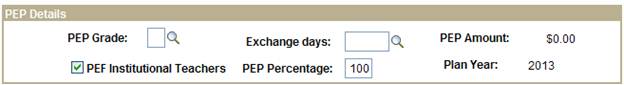

- In the PEP Grade field enter a 1, for employees SG-1 - SG-17, enter a 2, for employees SG-18 - SG-24. This is a required field in order to calculate the PEP credit accurately.

- In the PEP Percentage field type the employee's payroll/employment percentage. Click Save. (The default is 100%)

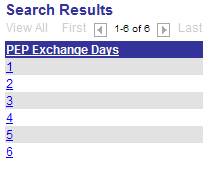

- In the Exchange days field, enter the number of days of annual/personal leave the employee forfeited for PEP. For SG-1 - 17, your available options are 3 or 6 days.

For SG-18 - 24, your available options are 2.25 or 4.5 days.

- If the employee is a PEF Teacher, select the box PEF Institutional Teachers. This is only to be used for teachers represented by PEF. This box will display once you tab out of the request date field.

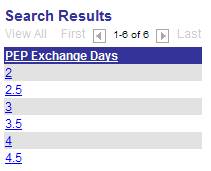

- If the enrollee is a PEF Teacher SG1 through 17 you should enter 1,2,3,4,5,or 6 days in the Exchange days field of the PEP Details section of the PEP enrollment form. This is only to be used for teachers represented by PEF.

- If the enrollee is a PEF Teacher SG18 through 24 you should enter 1, 1.5, 2, 2.5, 3, 3.5,4 or 4.5 days in the Exchange days field of the PEP Details section of the PEP enrollment form. This is only to be used for teachers represented by PEF.

To view the PEP percentage, follow the NYBEAS Navigation Menu links:

Benefits > History > PEP > Enrollment Inquiry

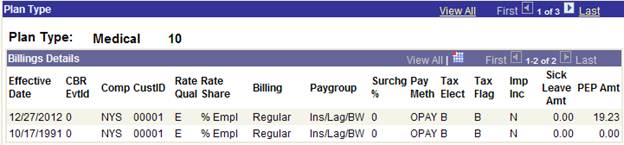

To view the PEP credit calculated, follow the NYBEAS Navigation Menu links:

Benefits > History > NYBEAS Update History and click on the Billings tab.

To view the actual PEP credit applied, follow the NYBEAS Navigation Path links:

Benefits > History > NYBEAS Update History and click on the Accounting tab.

Note: The actual PEP credit applied will be the lesser of the calculated amount or the enrollee's health insurance premium.

Timing of NYBEAS Processing

Since the transaction cannot be keyed until after the certification of the accrual adjustment, coordination with your agency's personnel/payroll staff who handles this is the key to PEP credit processing. The following chart indicates the dates to key the transaction and the corresponding paycheck which will be impacted. Be prepared to answer questions once the employee's paycheck has been affected.

This panel will be open for NYBEAS keying until January 9, 2013.

|

Employee's Payroll Cycle |

NYBEAS Keying Window |

Impacted Paycheck |

Paychecks credited with PEP Credit |

# of Retro PEP Credits |

|

Administration Lag |

11/12/12 - 12/18/12 |

1/02/2013 |

01/02/13 - 12/18/13 |

0 |

|

Administration Current |

11/12/12 - 12/04/12 |

12/19/2012 |

12/19/12 - 12/04/13 |

0 |

|

Institution Lag |

11/12/12 - 12/11/12 |

12/27/2012 |

12/27/12 - 12/12/13 |

0 |

|

Institution Current |

11/12/12 - 11/27/12 |

12/13/2012 |

12/13/12 - 11/28/13 |

0 |

|

Triple Lag |

11/12/12 - 12/24/12 |

1/10/2013 |

01/10/13 - 12/26/13 |

0 |

|

Employee's Payroll Cycle |

NYBEAS Keying Window |

Impacted Paycheck |

Paychecks credited with PEP Credit |

# of Retro PEP Credits |

|

Administration Lag |

12/19/12 - 01/02/13 |

1/16/2013 |

01/16/13 - 12/18/13 |

1 |

|

Administration Current |

12/05/12 - 12/18/12 |

1/02/2013 |

01/02/13 - 12/04/13 |

1 |

|

Institution Lag |

12/12/12 - 12/24/12 |

1/10/2013 |

01/10/12 - 12/12/13 |

1 |

|

Institution Current |

11/28/12 - 12/11/12 |

12/27/2012 |

12/27/12 - 11/28/13 |

1 |

|

Triple Lag |

12/26/12- 01/08/13 |

1/24/2013 |

01/24/13 - 12/26/13 |

1 |

|

Employee's Payroll Cycle |

NYBEAS Keying Window |

Impacted Paycheck |

Paychecks credited with PEP Credit |

# of Retro PEP Credits |

|

Administration Lag |

01/02/13 - 01/15/13 |

01/30/2013 |

01/30/13 -12/18//13 |

2 |

|

Administration Current |

12/19/13 - 12/31/13 |

1/16/2013 |

01/16/13- 12/04/13 |

2 |

|

Institution Lag |

12/26/12- 01/08/13 |

1/24/2013 |

01/24/13 - 12/12/13 |

2 |

|

Institution Current |

12/12/12 - 12/24/12 |

1/10/2013 |

01/10/13 - 11/28/13 |

2 |

|

Triple Lag |

01/09/13 - 01/22/13 |

2/7/2013 |

02/07/13 - 12/26/13 |

2 |

Timing of 2013 PEP Credit with 2013 Health Insurance Premium Deduction

For employees, the 2013 PEP credit will begin the same payroll period as the start of the 2013 health insurance premium deduction. All employees will still have 26 paychecks credited with the 2013 PEP credit. Assuming no retroactivity, the following chart indicates the start of the 2013 PEP credits and health insurance deductions for the various payrolls.

|

Employee's Payroll Cycle |

First Check with 2013 PEP Credit |

First Check with 2013 Health Insurance Premium Deduction |

|

Administration Lag |

1/2/2013 |

1/2/2013 |

|

Administration Current |

12/19/2012 |

12/19/2012 |

|

Institution Lag |

12/27/2012 |

12/27/2012 |

|

Institution Current |

12/13/2012 |

12/13/2012 |

|

Triple Lag |

1/10/2013 |

1/10/2013 |