The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

ANDREW M. CUOMO

GOVERNOR

DEPARTMENT OF CIVIL SERVICE

ALBANY, NEW YORK 12239

www.cs.ny.gov

JERRY BOONE

COMMISSIONER

NY13-22

TO: New York State Health Benefits Administrators

FROM: Employee Benefits Division

SUBJECT: Administrative Changes to Premium Contribution Update for Employees Represented by the Civil Service Employees Association (CSEA)

DATE: October 17, 2013

Previously it was announced that the State of New York and CSEA reached an agreement to update the administrative process used to calculate employees' health insurance premium contributions. Specifically, the State of New York and CSEA agreed to update affected employees' premium contribution rates to be coincident with the pay period of an applicable promotion or demotion.

Per the agreement, and as soon as practicable, EBD will provide agency Health Benefits administrators (HBAs) with a NYBEAS transaction that will allow them to update the premium rate contribution effective with the same pay period as an applicable promotion or demotion. Once that transaction has been developed, another HBA memo will be issued. In the interim, EBD will review CSEA payroll information on a quarterly basis and when applicable, update the premium contribution rate retroactive to the effective date of the payroll change.

The initial premium contribution change, subsequent to the agreement, was processed on July 30, 2013, using payroll information coincident with the pay period including May 1, 2013. EBD has processed the first "quarterly" update using payroll information coincident with the pay period including October 1, 2013.A The paychecks impacted are as follows:

|

Payroll Cycle |

First Paycheck with Change of Premium |

|---|---|

|

Administration |

October 23, 2013 |

|

Institution |

October 31, 2013 |

EBD has prepared and will mail a notification letter to each employee, indicating that a change was made. An example of this letter is attached. Please note that the premium contribution rate changes are coincident with the payroll change, so retroactive adjustments may apply.

Going forward, to avoid retroactivity during this interim period, HBA's should report an applicable change to the premium contribution rate as follows:

Interim Guidance

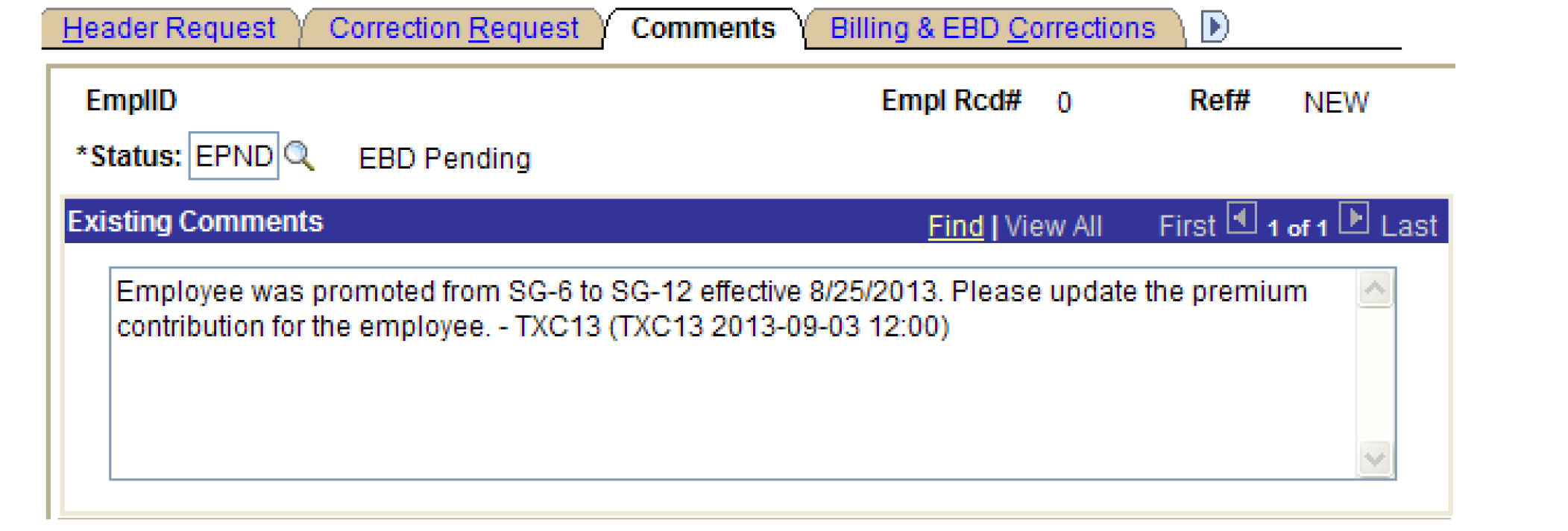

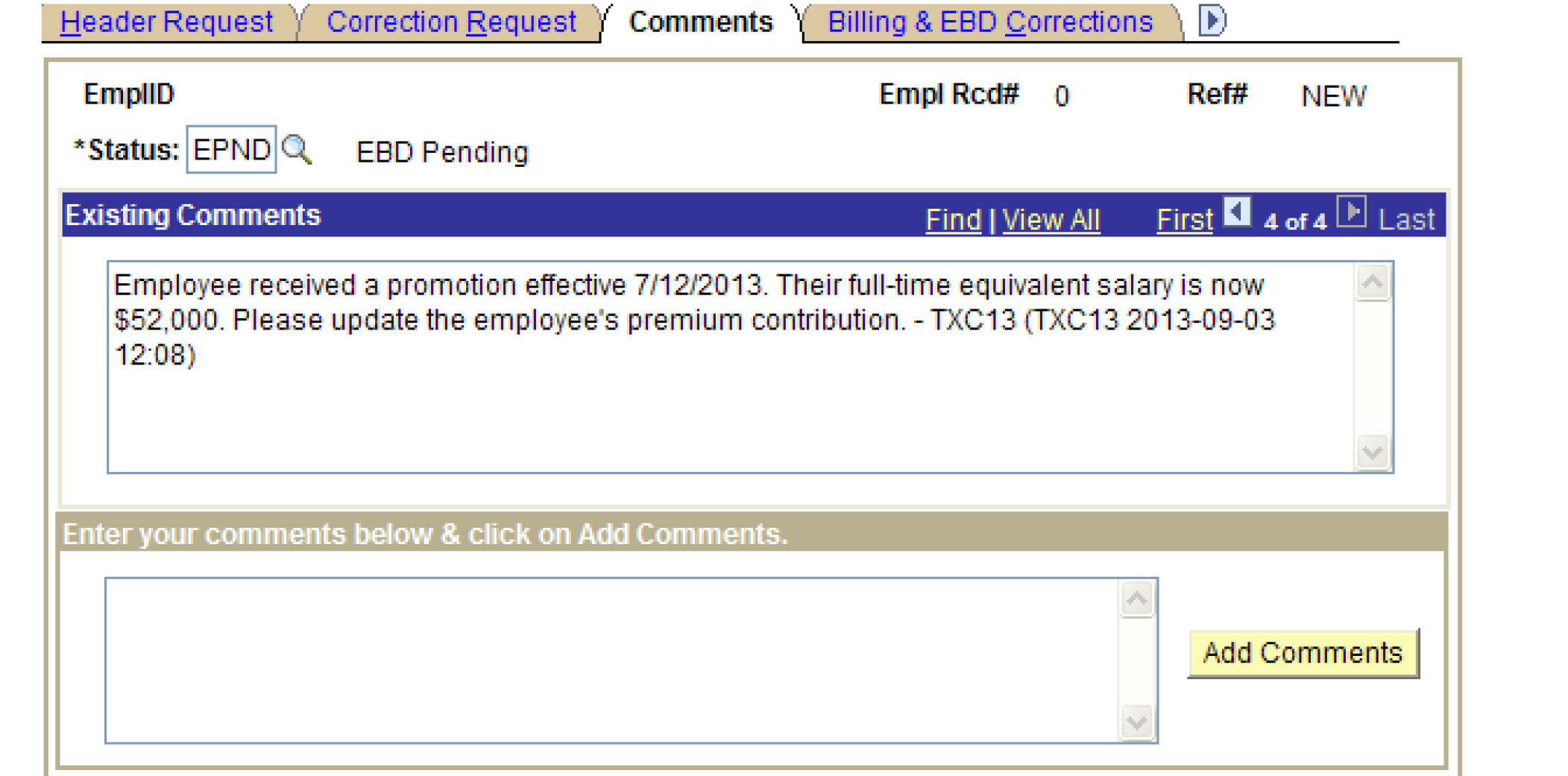

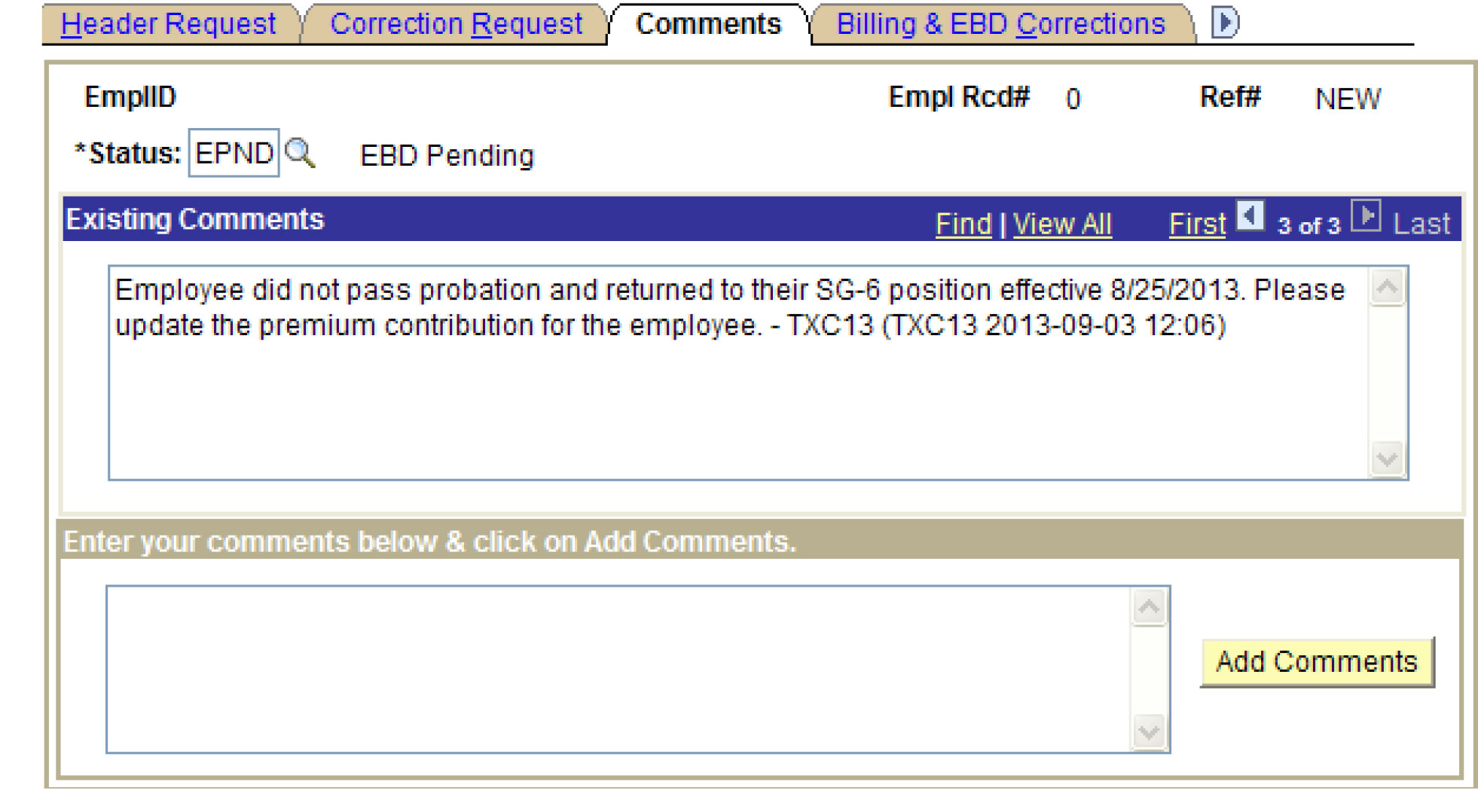

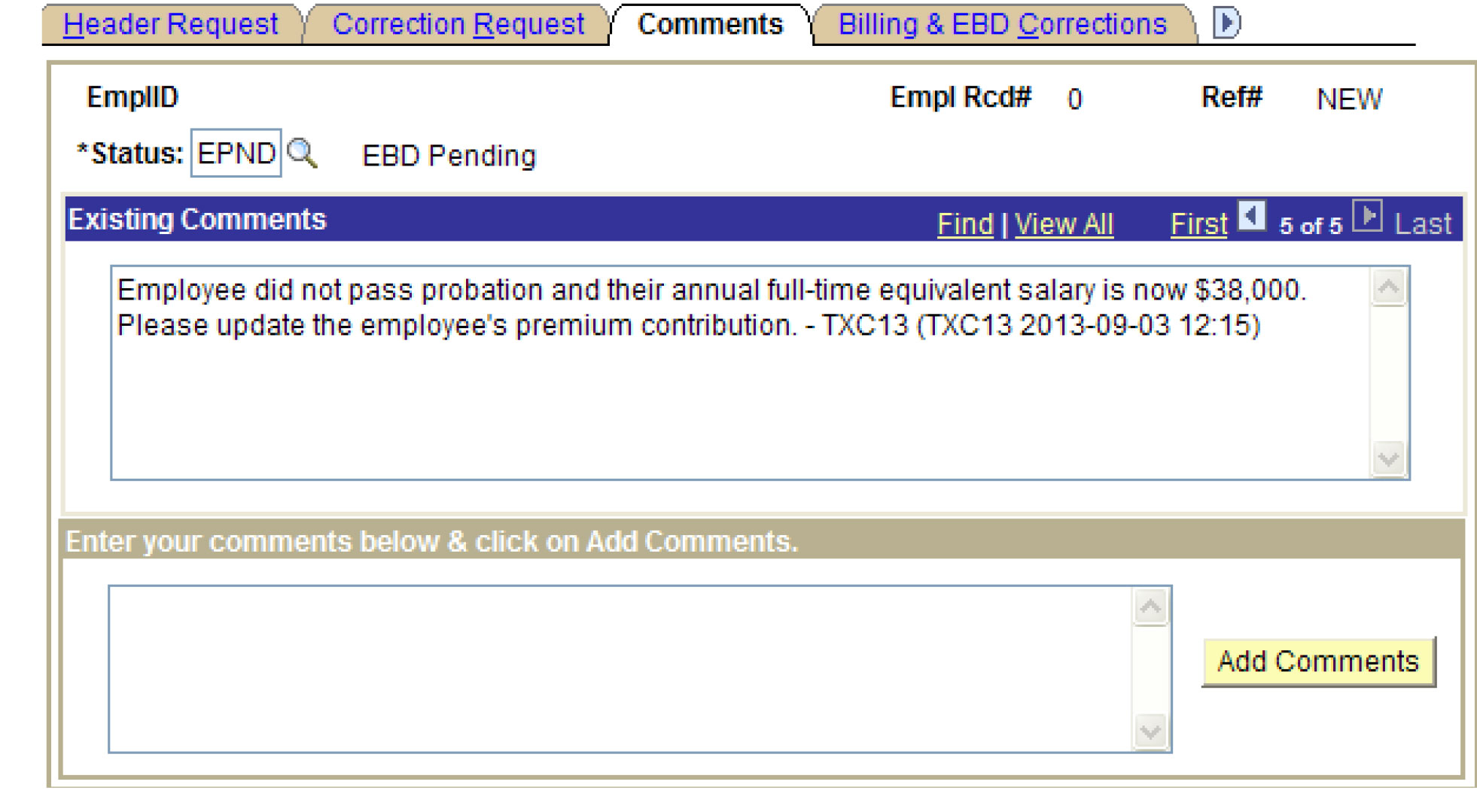

HBAs can report a CSEA represented employee who requires a premium contribution change by submitting a Correction Request to EBD. In the Correction Request, in the Comments panel, HBAs should include the date of the promotion or demotion and the requisite salary grade or full-time equivalent salary. Examples of how the corrections should be requested are below.

Sample Correction Request Submissions for HBAs to Report a CSEA Represented Employee Premium Contribution Rate Change

Request to Update Employee Premium Contribution Rate Due to a Promotion

Example #1 - Change in Salary Grade Necessitating Premium Contribution Rate Change

Example #2 - Change in Annual Full-Time Equivalent Salary Necessitating Premium Contribution Rate Change

Request to Update Employee Premium Contribution Rate Due to Demotion

Example #3 - Change in Salary Grade Necessitating Premium Contribution Rate Change

Example #4 - Change in Annual Full-Time Equivalent Salary Necessitating Premium Contribution Rate Change

Attachment

[DATE]

[EMPLOYEE NAME]

[EMPLOYEE ADDRESS]

Dear [EMPLOYEE NAME],

As your employer, New York State pays a portion of the premium for your health insurance coverage. You are responsible for paying the balance of the premium through biweekly payroll deductions. As a result of an agreement between CSEA and the State, your share of the cost for health insurance is based upon your pay grade level as shown in the table below.

| Pay Grade | Individual Coverage | Dependent Coverage | ||

|---|---|---|---|---|

| State Share | Employee Share | State Share | Employee Share | |

| Grade 9 and below | 88% | 12% | 73% | 27% |

| Grade 10 and above | 84% | 16% | 69% | 31% |

The New York State Department of Civil Service recently received notice from your personnel office that you experienced a change to your salary grade that results in a change in your biweekly premium deduction. Based upon the effective date of the salary grade change, you may be subject to retroactive health insurance premium adjustments. Your new biweekly deduction is $[COST]. If you have any questions regarding your contribution for health insurance coverage, please contact your Health Benefits Administrator within your personnel office.

Sincerely,

Barbara Vaughn

Assistant Director

Employee Benefits Division