The Empire Plan is a unique health insurance plan designed especially for public employees in New York State. Empire Plan benefits include inpatient and outpatient hospital coverage, medical/surgical coverage, Centers of Excellence for transplants, infertility and cancer, home care services, equipment and supplies, mental health and substance abuse coverage and prescription drug coverage.

KATHY HOCHUL

Governor

TIMOTHY R. HOGUES

Commissioner

PE23-01

PA23-01

PAEX23-01

TO: Health Benefits Administrators of Participating Employers and Participating Agencies

FROM: Employee Benefits Division

SUBJECT: Mandatory Federal Premium Reporting Requirement, Plan Year 2022

DATE: February 10, 2023

As part of the Consolidated Appropriations Act of 2021, the federal government has established an annual requirement that all health insurance issuers, employer-based health plans, and other group health plans report an average monthly premium paid by employees and an average monthly premium paid by employers. These reporting requirements are outlined in the Prescription Drug Data Collection (RxDC) Reporting Instructions published by the Centers for Medicare and Medicaid Services (CMS).

To meet this federal requirement, the Department of Civil Service must collect premium contribution information from Participating Agencies (PA) and Participating Employers (PE). To facilitate in data collection, agencies must utilize a dedicated page in NYBEAS to enter their total annual employee contributions for plan year 2022. This survey is mandatory for all NYSHIP PAs and PEs and must be completed by March 31, 2023.

To satisfy this requirement, locate the Federal Premium Reporting page in NYBEAS by following the instructions below.

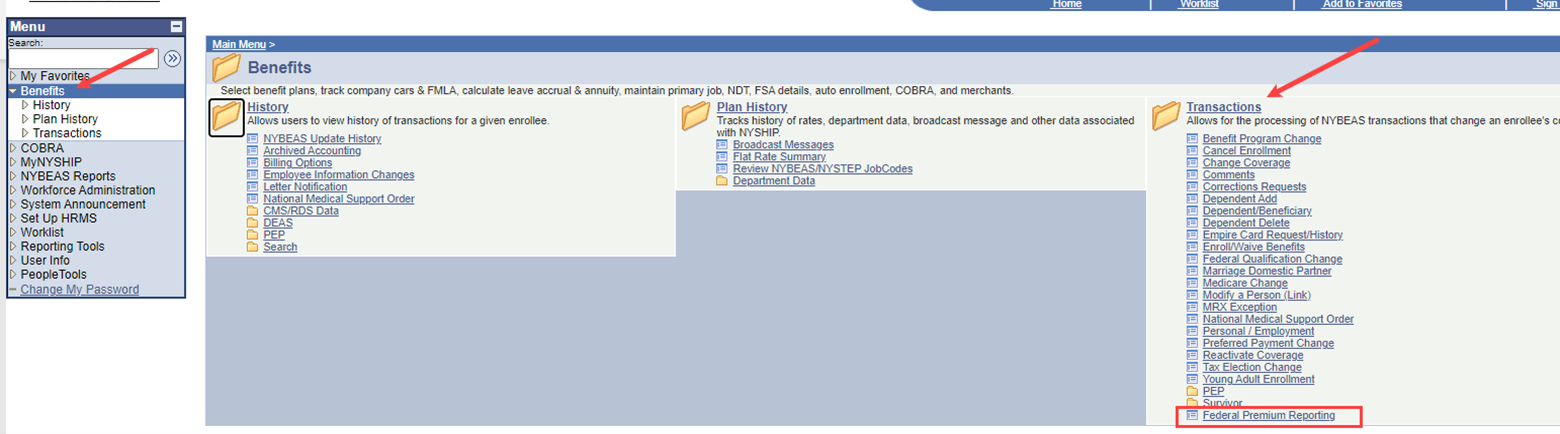

Sign into NYBEAS and select Benefits. Under the Transaction folder, select Federal Premium Reporting:

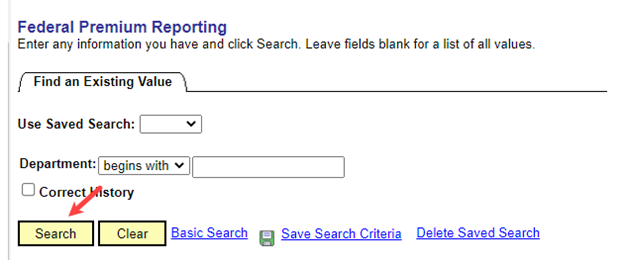

Enter your agency code in the Department box and click on Search.

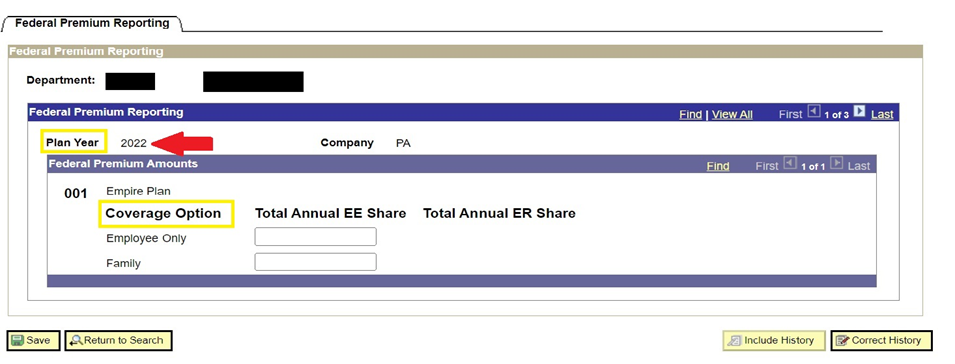

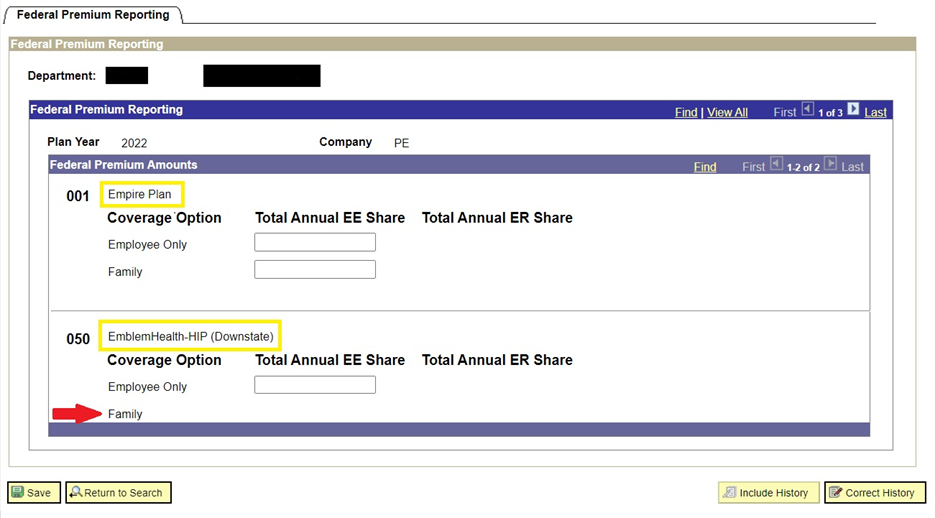

A new page will populate, and this is where agencies enter the Total Annual EE Share of the NYSHIP health insurance premium for each Benefit Plan (e.g. 001 Empire Plan vs. 009 Excelsior); and for each Coverage Option (e.g. Employee Only vs. Family coverage).

The Total Annual EE Share of the premium represents the total amount all employees, retirees, vestees, dependent survivors, COBRA, and Young Adult Option (YAO) enrollees (regardless of if the enrollee is plan-prime or Medicare-prime) paid for coverage for the plan year. The Plan Year is indicated at the top of the page.

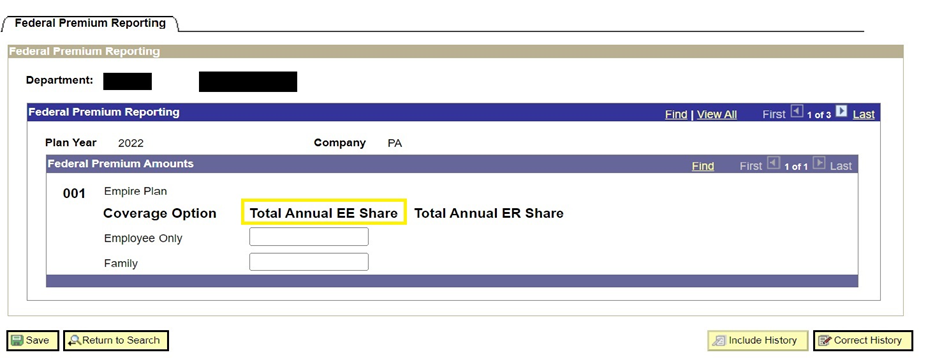

The Total Annual EE Share includes amounts your agency deducted from payroll checks, pension checks, or billed directly. You must also include amounts the Employee Benefits Division received from your agency's enrollees, such as direct billing or pension deductions for retirees, vestees, and dependent survivors. If your agency paid 100 percent of the premium for your enrollees, enter $0.01 in the Total Annual EE Share field. The page will not accept a value of $0.00. Once you enter an amount in the Total Annual EE Share field, the Total Annual ER Share field will auto-populate based on the total premium billed to your agency.

If your agency offers different NYSHIP plans, you will see a row for each Benefit Plan. Agencies must enter the Total Annual EE Share for each Benefit Plan and Coverage Option (HMO, Empire Plan, or Excelsior Plan) for 2022.

Agencies without any enrollees in a certain Coverage Option (Employee Only or Family) will have no data to enter. Please see example below. This agency offers both the Empire Plan and EmblemHealth-HIP (Downstate) options. In the 050 (HIP) option, there are no enrollees with Family coverage, therefore there is no Total Annual EE Share to enter.

Please note this is an annual federal reporting requirement. Agencies will be expected to report the Total Annual EE Share on an annual basis.

If you have any questions, please contact the HBA Help Line at (518) 474-2780.